Active investing: a definition

Active investing, as its name implies, takes a hands-on approach and requires that someone act in the role of a portfolio manager. The goal of active money management is to beat the stock market’s average returns and take full advantage of short-term price fluctuations. It involves a much deeper analysis and the expertise to know when to pivot into or out of a particular stock, bond, or asset. A portfolio manager usually oversees a team of analysts who look at qualitative and quantitative factors, then gaze into their crystal balls to try to determine where and when that price will change.

Active investing requires confidence that whoever is managing the portfolio will know exactly the right time to buy or sell. Successful active investment management requires being right more often than wrong.

Passive investing: a definition

If you’re a passive investor, you invest for the long haul. Passive investors limit the amount of buying and selling within their portfolios, making this a very cost-effective way to invest. The strategy requires a buy-and-hold mentality. That means resisting the temptation to react or anticipate the stock market’s next move.

The prime example of a passive approach is buying an index fund that follows one of the major indices like the S&P 500 or Dow Jones Industrial Average (DJIA). Whenever these indices switch up their constituents, the index funds that follow them automatically switch up their holdings by selling the stock that’s leaving and buying the stock that’s becoming part of the index. This is why it’s such a big deal when a company becomes big enough to be included in one of the major indices: It guarantees that the stock will become a core holding in thousands of major funds.

When you own tiny pieces of thousands of stocks, you earn your returns simply by participating in the upward trajectory of corporate profits overtime via the overall stock market. Successful passive investors keep their eye on the prize and ignore short-term setbacks—even sharp downturns.

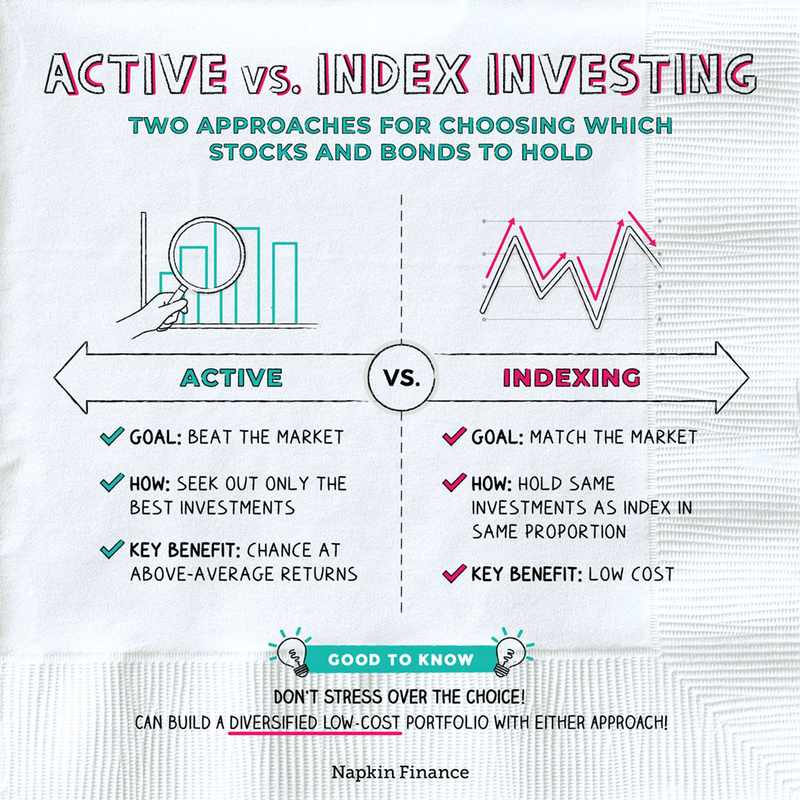

Distinguishing between active and passive investments

- Objective: active investments aim to ‘beat the market whereas passive investments track an index (hence they’re referred to as tracker or index funds)

- Technique: active fund managers pick the shares while passive investment vehicles replicate the composition of an index (for example, by buying shares in all the companies listed on the FTSE 100 in proportion to their relative market capitalization)

- Rationale: passive funds are based on the concept that markets are efficient and accurately priced. Active fund managers believe markets can be inefficient, creating opportunities to find mispriced and undervalued companies.

Both active and passive collective investment products pool money from investors to be invested by a fund manager in a basket of shares or other assets.

Advantages of active funds

- Potential: active fund managers try to ‘beat the market rather than replicate the average return for a particular index

- Flexibility: active funds have more freedom in their choice of investments. For example, investors seeking ethical investments can choose an ESG (environmental, social, and governance) fund

- Protection: active managers limit losses in falling markets by increasing their allocation of cash or lower-risk assets. They can also protect against geopolitical or sector-specific risks, for example, by moving investments out of a particular country.

Disadvantages of active funds

- Higher fees: active funds charge high fees to cover the expertise and resources they require. According to trading platform AJ Bell, the average annual fee in the UK All Companies sector was 0.86% for active funds, compared to 0.17% for passive funds

- Performance: the performance of the fund depends on the skill of the manager. Fund managers aim to outperform the index, which may result in their making higher-risk choices

- Volatility: the fund may hold a smaller number of investments relative to an index tracker. This can increase volatility as performance is dependent on a concentrated basket of shares.

Advantages of passive funds

- Lower fees: passive funds typically charge lower fees than their active counterparts as replicating an index is more straightforward than stock-picking. According to Morningstar, 90% of passive funds charge an annual fee of less than 0.5%, compared to only 13% of active funds.

- Less reliance on the fund manager: investors are not reliant on the stock-picking skills of the fund manager and will receive the average return for the index as a whole.

- Decreased risk: depending on the index, passive funds will invest in hundreds of shares. This provides investors with a well-diversified portfolio and lessens the risk of reduced returns from individual shares underperforming.

- Transparency: investors know the underlying holdings of passive funds as they are the constituents of the relevant index. There is less transparency for active funds as fund managers are less keen to reveal their underlying investments.

Disadvantages of passive funds

- No scope for outperformance: although investors may be able to generate higher returns by tracking one index over another, they lose the potential to outperform the index.

- Limited protection in market downturns: passive funds cannot reallocate their portfolio to protect against potential losses, for example, holding a higher proportion of cash or investing more defensively.

- Concentration: passive funds are weighted by the market capitalization of the companies in the index. This can result in the performance – good or bad – of a small number of companies having a disproportionate impact on the overall performance of the fund. For example, Apple accounts for 11% of the S&P 100, with the top 10 companies representing 43% of the overall weighting of the index, according to S&P Global.

- Lack of flexibility: passive funds may offer a limited choice for investors wanting to invest in certain sectors, such as ESG.

Did active funds outperform passive funds?

The crux of the debate centers around whether active funds have justified their higher fees by outperforming their passive counterparts.

This can be split into two parts: the proportion of active funds that have outperformed, and their degree of outperformance.

1. Proportion of ‘out-performing’ active funds

The table below shows the percentage of active funds that have outperformed their passive peers, based on total returns for the 10-year period ending December 2021.

Sector | The proportion of outperforming active funds |

UK | 85% |

Global emerging markets | 72% |

Europe (ex UK) | 64% |

Asia Pacific (ex-Japan) | 63% |

Global | 30% |

North America | 22% |

Source: AJ Bell | ㅤ |

Active funds have fared most poorly in the North American and Global sectors, with only 22% and 30% respectively of active funds beating passive funds. This is partly due to the US sector being well-covered in terms of research, which makes it harder for fund managers to find ‘bargains’.

North American fund managers also face the difficult decision of whether or not to invest in the technology giants that have delivered high returns over the last decade, with the risk that they end up becoming quasi-tracker funds.

These stocks have a disproportionate weighting in both US and global funds, and their associated returns, due to their high market capitalizations.

The UK has been a happier hunting ground for active fund managers, with 85% of active funds outperforming. Many of these funds invest in small and mid-cap companies, where there’s more opportunity for stock-picking and the potential for higher returns.

2. Degree of outperformance

It’s also important to look at the margin by which active funds outperform passives:

Sector | Active returns | Passive returns | Difference |

UK | 134% | 96% | +38% |

Global emerging markets | 115% | 91% | +24% |

Asia Pacific (ex-Japan) | 166% | 143% | +23% |

Europe (ex UK) | 202% | 185% | +17% |

Global | 240% | 277% | -37% |

North America | 353% | 404% | -51% |

Source: AJ Bell, 10-year total returns | ㅤ | ㅤ | ㅤ |

As expected, the North American and Global active funds achieved a lower average return than passives, although it’s worth noting that the active funds here delivered by far the highest returns of all sectors.

Clearly, it isn’t always possible to pick the best-performing fund, but active funds have the potential to deliver far higher returns to investors. That said, not all active funds justify their higher management fee in terms of outperforming passive funds, particularly in certain sectors.

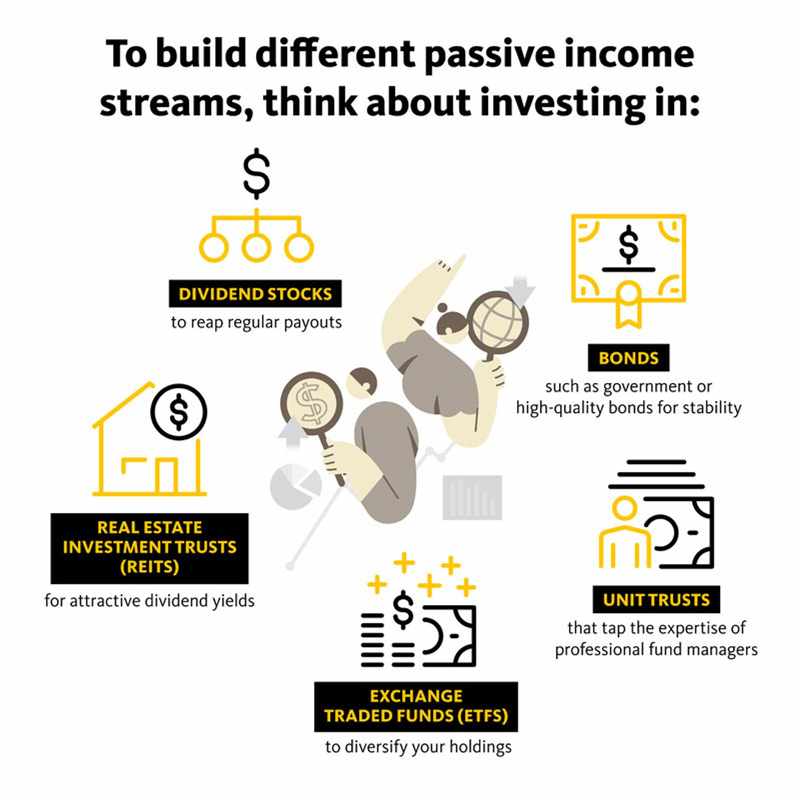

What are the different types of active and passive investments available?

These are the two most popular types of actively-managed investments:

- Funds (also known as Open-Ended Investment Companies or OEICs): these are the most common actively-managed products bought by investors. They cover a variety of sectors, geographies, and assets.

- Investment trusts: these are another actively-managed option that pools investors’ money to buy a basket of underlying shares or assets. One of the main differences to funds is that investment trusts are allowed to retain 15% of annual income in a ‘rainy day’ reserve, allowing them to maintain a constant dividend stream in market downturns.

Similarly, there are two main types of passively-managed investments:

- Funds: passively-managed funds track an index, such as the FTSE 100 or S&P Global 500.

- Exchange-traded funds (ETFs): Like passive funds, they track an index, but they can be bought and sold throughout the day, rather than once a day as for funds.

Active vs. Passive funds – which should you invest in?

The simple answer is that there’s a place for both types of investment as part of a balanced portfolio.

Based on past performance (which is not a guide to future performance), investors might want to look at passive funds for exposure to the North American and global sectors. These provide a low-cost way for investors to benefit from an overall rise in the stock market.

Active funds have more of a role to play in other sectors, particularly in the UK and emerging markets. Fund managers have more opportunities to use their research skills to find high-growth companies, or potentially undervalued companies, in these markets.

Both Morningstar and Trustnet provide data benchmarking active and passive funds and ETFs against their peers. These are useful resources for investors wanting to compare funds across different types and sectors.

However, investors should look for funds that consistently perform in the top quartile against their peers over three years or more, rather than falling into the trap of investing in ‘last year’s winners.

It’s also worth comparing the best trading platforms for your portfolio as the range of investments and fees can vary significantly.

How to make passive investing work

One of the most popular indexes is Standard & Poor’s 500, a collection of hundreds of America’s top companies. Other well-known indexes include the Dow Jones Industrial Average and the Nasdaq 100. Hundreds of other indexes exist, and each industry and sub-industry has an index comprised of the stocks in it. An index fund – either as an exchange-traded fund or a mutual fund – can be a quick way to buy the industry.

Exchange-traded funds are a great option for investors looking to take advantage of passive investing. The best have super-low expense ratios, the fees that investors pay for the management of the fund. And this is a hidden key to their outperformance.

ETFs are typically looking to match the performance of a specific stock index, rather than beat it. That means that the fund simply mechanically replicates the holdings of the index, whatever they are. So the fund companies don’t pay for expensive analysts and portfolio managers.

What does that mean for you? Some of the cheapest funds charge you less than $10 a year for every $10,000 you have invested in the ETF. That’s incredibly cheap for the benefits of an index fund, including diversification, which can increase your return while reducing your risk.

In contrast, mutual funds are typically more active investors. The fund company pays managers and analysts big money to try to beat the market. That results in high expense ratios, though the fees have been on a long-term downtrend for at least the last couple of decades.

However, not all mutual funds are actively traded, and the cheapest use is passive investing. These funds are cost-competitive with ETFs, if not cheaper in quite a few cases. In fact, Fidelity Investments offers four mutual funds that charge you zero management fees.

So passive investing also performs better because it’s simply cheaper for investors.

Special factors to consider

So, which of these strategies makes investors more money? You’d think a professional money manager’s capability would trump a basic index fund. But they don’t. If we look at superficial performance results, passive investing works best for most investors. Study after study (over decades) shows disappointing results for active managers.

Active mutual fund managers, both in the United States and abroad, consistently underperform their benchmark index, with studies showing that between 86 and 95% of actively managed mutual funds did not fulfill their goal of beating the market on an after-tax basis throughout the 2000s.3 Similarly, research from S&P Global found that over the 15-year period that ended in 2021, only about 4.5% of professionally managed portfolios in the U.S. were able to consistently outperform their benchmarks. After accounting for taxes and trading costs, the number of successful funds drops to less than 2%. Several other analyses report similar findings.

Only a small percentage of actively-managed mutual funds ever do better than passive index funds.

All this evidence that passive beats active investing may be oversimplifying something much more complex, however, because active and passive strategies are just two sides of the same coin. Both exist for a reason, and many pros blend these strategies.

However, reports have suggested that during market upheavals, such as the end of 2019, for example, actively managed Exchange-Traded Funds (ETFs) have performed relatively well. While passive funds still dominate overall, due to lower fees, investors are showing that they're willing to put up with the higher fees in exchange for the expertise of an active manager to help guide them amid all the volatility or wild market price fluctuations.

Real-life examples

Many investment advisors believe the best strategy is a blend of active and passive styles, which can help minimize the wild swings in stock prices during volatile periods. Passive versus active management doesn’t have to be an either/or choice for advisors. Combining the two can further diversify a portfolio and actually help manage overall risk. Clients who have large cash positions may want to actively look for opportunities to invest in ETFs just after the market has pulled back. Retirees who care most about income, these investors may actively choose specific stocks for dividend growth while still maintaining a buy-and-hold mentality. Dividends are cash payments from companies to investors as a reward for owning the stock.

Moreover, it isn’t just the returns that matter, but risk-adjusted returns. A risk-adjusted return represents the profit from an investment while considering the level of risk that was taken on to achieve that return. Controlling the amount of money that goes into certain sectors or even specific companies when conditions are changing quickly can actually protect the client.

For most people, there’s a time and a place for both active and passive investing over a lifetime of saving for major milestones like retirement. More advisors wind up using a combination of the two strategies—despite the grief; the two sides give each other their strategies.

FAQ

How much of the market is passively invested?

According to industry research, around 17% of the U.S. stock market is passively invested and should overtake active trading by 2026. In terms of mutual fund money, around 54% of U.S. mutual funds and ETF assets are in passive index strategies as of 2021. Passive funds overtook active funds in 2018.

Is it possible for all ETFs to be passive?

No. While ETFs have staked out a space for being low-cost index trackers, many ETFs are actively managed and follow a variety of strategies.

What is the first passive index fund?

The first passive index fund was Vanguard's 500 Index Fund, launched by index fund pioneer John Bogle in 1976.

Is It possible to invest both actively and passively?

Mutual funds and exchange-traded funds can take an active or passive approach. Investors can mix and match. They can be active traders of passive funds, betting on the rise and fall of the market, rather than buying and holding like a true passive investor.