The definition of a stockbroker

A stockbroker is a financial expert who places trades for clients in the market. Most stock brokers work for brokerage companies and deal with a variety of retail and institutional clients.

The majority of stock brokers work for brokerage firms and conduct business with several individual and institutional clients. Although the methods of compensation differ per employer, commission-based payments are frequently made to stockbrokers.

Stockbrokers is another term that is occasionally used to refer to both brokerage firms and broker-dealer businesses. These include both discount and full-service brokers who execute trades but do not provide specific investment advice to their clients.

At least at their most basic levels of service, the majority of internet brokers are discount brokers, meaning that trades are handled for no charge or for a little set-price commission. Today, a lot of online brokers provide superior services at a price premium. To assist you in finding a broker that meets your needs, Investopedia keeps lists of the top Robo-advisors and finest online brokers.

What does a stockbroker do?

To purchase or sell stocks, one needs to have access to one of the major exchanges, such as the NASDAQ or the New York Stock Exchange (NYSE). You must be a member of the exchange or work for a member firm in order to trade on these exchanges. The Financial Industry Regulatory Authority (FINRA) issues broker or broker-dealer licenses to member companies and many of the people who work there.

Although it is technically feasible for an individual investor to purchase stock shares directly from the company that issues them, working with a stockbroker is far more straightforward.

Until recently, entrance to the stock markets was prohibitively expensive. Only high-net-worth individuals or significant institutional investors, such as pension fund managers, could afford it. They utilized full-service brokers, and the cost to execute a trade might be in the hundreds of dollars.

However, the emergence of the internet and associated technological advancements cleared the path for discount brokers to offer online services with affordable, quick, and automated market access. More recently, micro-investors have been catered to by apps like Robinhood and SoFi, which even allow fractional share purchases. The majority of accounts in the markets today are controlled by discount brokers and handled by the account owners.

Some examples of stockbroker tasks and responsibilities are:

- Examining a client's financial status and developing a strategy for investments

- Tracking the state of the market and staying up to date with financial sector regulations

- Helping investors accomplish financial transactions and keeping records of accounting

- On behalf of clients, managing shares and other financial items

- Finding out for customers about stocks, securities, market circumstances, and governmental regulations

- Analyzing information from financial publications, reports, and stock quotation screens

- Provide knowledge and guidance on financial markets, circumstances, and goods

- Performing the buy and sell orders for their clients.

- Providing trade data, including the number of shares bought and sold and their corresponding values

- Keeping track of stock prices, market movements, and offers for bonds and other securities

- Analyzing and interpreting data from multiple sources to ascertain the financial health of an organization

- Meeting with potential customers to determine their individual investing preferences or objectives

- Promoting financial products and services to potential customers

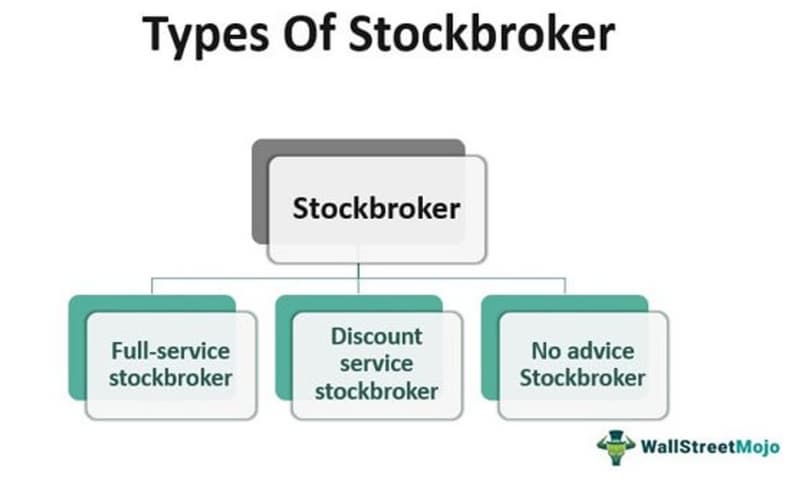

Stockbrokers – the different types

Full-service brokers

Full-service brokers give their clients personalized service and share crucial, confidential information that is only available to full-service clients. They provide customized research and investing information.

Online brokers

Online brokers do research and offer their clients a selection of stocks to choose from, as well as investment news, charts, and other information.

Discount brokers

Discount brokers only execute orders received from clients. They don't provide services for advice, research, or analysis.

Brokerage firms – the different types

While stockbrokers can work individually, the majority of them are employed by investment banks or brokerage firms, sometimes known as "brokerage companies" or simply "brokerages." In order to benefit clients on both sides of the financial transaction, these organizations pool their purchasing and selling expertise. They do this by connecting sellers of securities with potential buyers of financial products like stocks, ETFs (exchange-traded funds), and mutual funds.

There are three main categories of brokerages:

| Description | Benefits | Drawbacks | |

| Direct Access Brokerage | To provide active traders with the quickest transactions possible, direct access | Solutions based on technology, with a focus on speedy execution and easy access for investors who have already done their own research | Rapid trade execution could increase the investor's losses. |

| Discount Brokerage | Discount brokers try to provide the most affordable transaction. | Flat brokerage rates, no trading commissions, and improved accessibility for regular investors | The investor might have to use an internet platform to carry out their own trades. |

| Full-Service Brokerage | A full-service stockbroker provides comprehensive, end-to-end transaction support. | Personalized investment guidance, education on trading tactics, and maybe financial planning, with little effort required on the investor's part | The most expensive end of the brokerage spectrum are full-service brokers. |

Advantages and disadvantages of stockbrokers

There are ups and downs to being a stockbroker. Here are some advantages and disadvantages:

Advantages

- Excellent job choice for those with extensive stock market expertise.

- Provides the chance to make a high income.

- Suitable for ambitious individuals with great selling abilities.

Disadvantages

- Must be capable of handling pressure and rejection.

- A work setting that is competitive.

- Possibly extremely long hours of work.

- Due to the growth of internet trade, it could be difficult to develop a clientele.

Educational requirements for stockbrokers

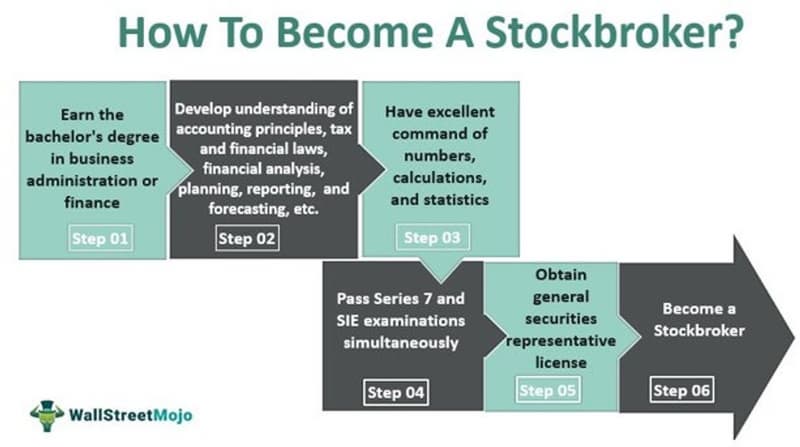

Stockbrokers normally need a bachelor's degree in finance or business administration. For those working in the industry, it is helpful to have a solid grasp of accounting procedures, economics, currency fundamentals, financial planning, and financial forecasting.

As indicators of legitimacy and financial savvy, international credentials are likewise becoming more and more in demand. Examples include the designations of chartered financial analysts (CFA) and certified financial planners (CFP).

Recommended courses you can take

- BSc Business Management

- BSc Accounting with Finance

- MSc Corporate Financial Management

- MSc Strategic Business Management

While pursuing your courses, you can look for a job placement or internship with a brokerage company to get relevant experience. Services for employability provide many options for acquiring job experience while you are still in school.

Before you can start working as a stockbroker, you must register with the Financial Conduct Authority (FCA) and have all the training and experience required. By registering with the FCA, you become an "authorized person," which gives you permission to engage in what the FCA refers to as "regulated functions." The FCA guidelines must be followed by all stockbrokers.

Stockbrokers can get entry-level work in a lot of degree programs. You can start applying for stockbroker opportunities once you have acquired the required education, experience, and registration with the FCA.

Potential career path for a stockbroker

Some people may be wondering if stockbrokers still exist or if this is a vanishing career path due to developments in automated financial services and investment technology, such as e-trading, Robo-advising, and micro-investing smartphone platforms that have enabled self-directed transactions for investors. There are still situations where a broker is required, even if the need for human brokers to offer rookie investors access to the stock market has decreased due to internet trading platforms. For instance, a broker may be needed to handle big orders placed on behalf of an institutional client or a high-net-worth individual investor. For reasons of anonymity, some investors might also like doing their trades through a trading representative.

Potential stockbroker salary

Brokerages have often functioned using a commission-based business model, where client fees are received after a successful transaction. New profit models have been established in recent years as a result of numerous well-known online trading platforms eliminating transaction fees. and new business models have been adopted, such as paying brokers according to the number of trades they bring in on exchanges.

The institution, customers, and amount of broker expertise all influence stockbroker pay. 2020 saw a $60,644 median pay for stockbrokers, with an average range of $40,000 to $123,000.

The licensing requirements for stockbrokers

Registered brokers in the US must be sponsored by a registered investment business and possess the FINRA Series 7 and Series 63 or 66 licenses. In the United States, floor brokers are required to be members of the stock exchange where they work.

The Canadian Securities Course (CSC), the Conduct and Practices Handbook (CPH), and the 90-day Investment Advisor Training Program are prerequisites for aspiring stockbrokers in Canada. They should also be currently employed by a brokerage business (IATP).

Candidates must be employed by a licensed brokerage business in Hong Kong and pass three exams administered by the Hong Kong Securities Institute (HKSI). Even after passing the exam, applicants still need to have their licenses approved by the financial regulating agency.

In Singapore, completing four exams—Modules 1A, 5, 6, and 6A—given by the Institute of Banking and Finance is a requirement to become a trading representative. The Singapore Exchange (SGX) and the Monetary Authority of Singapore (MAS) are in charge of licensing.

Stockbroking is highly regulated in the UK, and brokers are required to obtain certifications from the Financial Conduct Authority (FCA). Individual credentials are determined by the employer's and the broker's specific job requirements.

In short, the steps to becoming a stockbroker are:

Guidance on how to become a stockbroker is provided below:

1. Obtain a degree or diploma

For those who want to become stock brokers, there are two main educational routes. An authorized institution offers a three-year degree program in finance, accounting, or business, or a two-year vocational education and training (VET) program. Think at VET programs in areas including accounting, risk management, financial management, financial analysis and reporting, and security trading. Examine course descriptions to make sure they support your professional objectives.

2. Complete a financial company internship

You can complete a professional year as an aspiring stockbroker under the guidance of an established advisor. Most stockbrokers begin their careers as trainees with brokerage companies. Internships and entry-level training are excellent ways to acquire real-world experience and obtain your professional license. You may study how different investments compare, analyze the outcomes, and manage client money. Look for businesses that offer structured training programs where you may learn efficient sales strategies, time-management tactics, and how the stock exchange and financial markets operate.

3. Obtain a license

When you have finished your education and training, you should submit an application for an Australian Financial Services (AFS) license. Stockbrokers and other professionals who offer financial services must obtain licenses from the Australian Securities and Investments Commission (ASIC), which is the organization that does this. Anyone with a license is able to lawfully advise their customers and purchase, sell, and trade stocks, mutual funds, and other assets. Spend some time reading the AFS licensing kit several times, and then get your supporting paperwork ready. You can download a pre-application, fill it out, and send it to ASIC, or you can submit your application online using their web system.

4. Look for positions in stockbroking

You can begin applying for positions with brokerage firms once you have received a license from AFS. Check out credible websites and job boards, such as Indeed Jobs, which provides a list of available positions. Consider subscribing to email alerts to receive the most recent job information in your inbox.

While some firms use job portals, others request that applicants submit their applications through their human resources (HR) division. Carefully read the job description before creating an application that highlights your skills and expertise. Include any supplementary paperwork, such as diplomas, professional certifications, and transcripts.

5. Develop a client base

Once you land a job, you should start cultivating a customer. Your expertise in stockbroking may be used by these people or businesses to invest in stocks and other securities. Make calls to the prospects on your pre-qualified list to offer items or convince them to open trading accounts.

Stockbrokers – the 21st Century

Discount broker companies hire brokers to serve as branch officers in real locations or as voice brokers who can answer simple questions over the phone. Additionally, they could consult clients who have premium subscriptions with the online broker.

Stockbrokers typically work for specialized brokerage companies or investment banks. Large and complex orders are handled by these businesses for institutional customers and wealthy people (HNWI).

Another recent development in broker services is the emergence of Robo-advisers, algorithmic investment management carried out via online or mobile app interfaces. As there is little individual interaction, costs are kept low.

FAQ

What other similar job prospects can you look for?

Other positions in the financial sector that concentrate on institutional investing include:

- Financial trading

- Currency trading

- Trading and sales

How much money would you need to spend on an online broker?

There is no requirement to start. Some online brokerage platforms, like TD Easy Trade, don't require any minimum investments, and you can really buy and sell TD ETFs with no fees. Consider TD Direct Investing, though, if you're hoping to invest in a wider variety of assets. No minimum investment requirement exists. Additionally, you can avoid the $25 quarterly maintenance fee if you fulfill the minimal investment requirements, execute 3 transactions each quarter, or enroll in recurring monthly contributions (auto deposits) of $100 or more.

How long does it take to become a stockbroker?

Depending on the path a person takes, the time it takes to become a stockbroker may change. An approved university requires four years to complete a bachelor's degree. Programs for vocational education and training normally last one to two years. It could take six months to a year to finish licensure requirements and complete internships.

Where is a stockbroker's place of work?

Most stockbrokers are employed by full-service brokerage companies, where they deal with transactions for high-net-worth people and businesses. Others work for bargain brokers and assist various types of clients. Banks, accountancy firms, building societies, and businesses in the finance and investment industries employ some brokers.

What is a day in the life of a stockbroker like?

The majority of a stockbroker's day is spent on the phone, responding to emails, and pitching stock ideas to potential or current clients. The majority of brokers arrive at work early to read business publications and analyze the day's trades. Before making deals and concluding the day's paperwork, brokers may meet with customers in person to assess their investment portfolios and go through investment options.