Defining inflation

This year, stock markets all across the world have experienced a significant correction. Inflation has been rising simultaneously all around the world, reaching a 40-year high in the United States at 9.1% and touching 7.01% in India as of June 2022. Furthermore, just in 2022, the U.S. Federal Reserve raised interest rates by 225 basis points (bps).

You are correct to wonder if these two elements are connected. However, there is much more to it and the solution is not as straightforward as it first appears. So let's first examine what inflation is and its different forms before considering how it affects equities markets.

Simply said, inflation is a steady increase in the level of all prices. For instance, if inflation is 7% today and a house was worth INR 1 crore last year, it will now be worth INR 1.07 crore. The price of identical houses would increase as inflation increased.

The numerous forms of inflation are as follows:

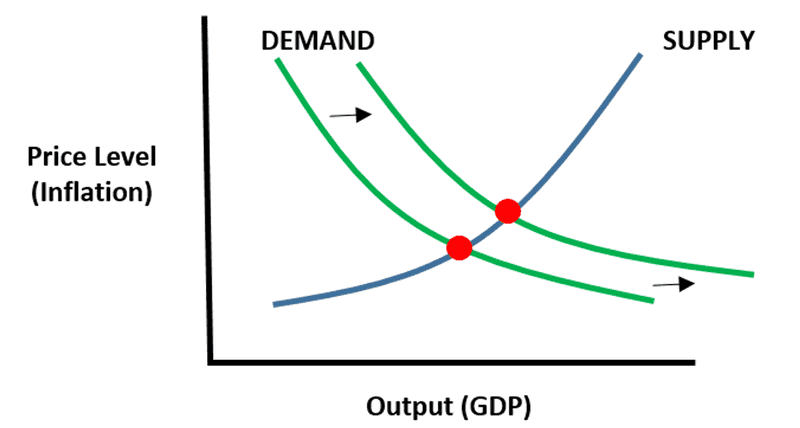

Demand-Pull Inflation

Our purchasing power grows when we have extra cash on hand. Demand for goods and services rises as a result. When this occurs, we observe an increase in the cost of goods and services, which, in turn, increases the profitability of businesses. This is also referred to as demand-pull inflation and is what we refer to as demand-side inflation. For instance, at first, as Covid-19 spread, the demand for disinfection products increased while the supply stayed the same. People were willing to pay more due to the increasing demand, which caused the price of disinfection goods to rise generally.

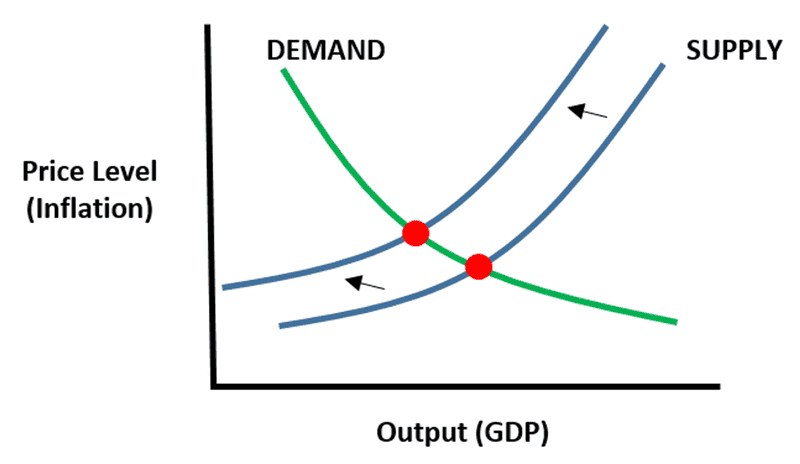

Cost-Push Inflation

When there are delays in the delivery of goods or services owing to shortages, inflation also rises. The rise in oil prices brought on by the conflict between Russia and Ukraine is a further example of inflation brought on by supply-side shortages. A spike in the price of many other goods, including agricultural commodities, has also been caused by supply restrictions and disruption. Even though there isn't a sudden or considerable increase in demand with this sort of inflation, prices rise as a result of relative scarcity in the supply. Either businesses or consumers are responsible for bearing the burden of increased manufacturing costs. This is referred to as Cost-Push Inflation.

Referring back to our earlier example, as Russia exported 11% of the world's crude oil, production of crude oil was halted or reduced, and supply did not keep up with demand when the current Russia-Ukraine war threatened a range of commodities, including crude oil. The price of crude oil increased as a result of this disruption in supply. Despite some government measures to control the price of crude oil, consumers continued to pay more for this price increase.

Companies' profitability or earnings could drastically decline if this additional cost is paid for by them, which would have an influence on their profitability. Poor corporate profits are likely to affect its stock price expectation since a company's stock price and long-term returns increase in tandem with its earnings growth.

On the other hand, if higher prices are passed through to customers, it will drastically cut their disposable income and, as a result, the amount of money that is available for investment.

When inflation rises, what happens?

Central banks, like the Reserve Bank of India (RBI), often raise interest rates on deposits and loans to make up for the loss in buying power brought on by growing inflation. The goal is to encourage consumers to conserve more money and thereby lower the surplus demand. Central banks attempt to minimize excessive liquidity in the economy by raising interest rates, which may also lower inflation.

They do, however, utilize instruments to restrict the flow of money into the economy, such as interest rates, open market operations (i.e., buying and selling of government bonds), etc. Demand-side inflation can be managed by central banks, whereas supply-side inflation is reliant on government intervention and policies.

In its efforts to keep inflation under control, the RBI maintains a close eye out for any early warning signals of an unanticipated increase in inflation and takes action to keep inflation within its target. The Consumer Price Index (CPI), which measures retail inflation in India, is currently being maintained at 4% with a 2% tolerance on either side by the central bank. However, from the beginning of 2022, inflation has been fast beyond RBI's 6% upper tolerance level due to price increases in global commodities, particularly food and crude oil, brought on by the current Russian-Ukrainian War. This surge has lasted for 6 consecutive months. In order to tighten the money supply in the economy and combat the rising inflation, the RBI has increased interest rates, or the repo rate, by 140 basis points (bps) thus far in 2022.

How does inflation affect the stock market?

As seen, monetary authorities raise interest rates in response to rising inflation. The risk-reward ratio increases as interest rates rise, which causes assets to move from equities to debt. How? Assume a debt instrument previously offered 6% annual yields. and as a result of an increase in interest rates, is now providing 8% annually. If stock returns remain at 15%, the risk-reward ratio has fallen from 2.5 times (15%/6%) to 1.9 times (15%/8%). One of the main reasons why investors commonly convert from equity to debt is the lowering risk-reward ratio brought on by rising interest rates.

Even FIIs have started withdrawing more money from Indian Equity Markets as a result of recent rake hikes. FIIs have redeemed for a total of INR 1.79 lakh crore over the past six months, from February 2022 to July 2022, compared to INR 56,588 crore over the preceding six months, from August 2021 to January 2022.

FIIs invest in India despite the fact that it is a riskier market than their home markets because of the relatively high returns. Given that FIIs often come from developed economies where risk is lower than in India if interest rates rise in other countries as well, they might decide to send money back home if the risk-return profile is better there. Additionally, FIIs typically repatriate money when they see an increase in world threats. This is also the reason why the BSE S&P Sensex and NIFTY 50 plummeted from their respective peaks in October 2021 by 6.79% and 7.14%, respectively.

Now we can relate that as interest rates increased as a result of growing inflation, returns on deposits and debt programs also increased. The majority of banks are currently offering between 5.25% and 5.75% for deposits between 1-3 years, while fixed deposit rates have increased by 10 bps to 30 bps for various tenures. Additionally, company fixed deposits (CFDs), tax-free bonds, government securities, and debt mutual funds all offer higher predicted returns.

You can see that the demand for riskier and possibly high-yielding assets, like equities, decreases when we save more in fixed-income routes because of the higher interest rates they offer. This also affects the risk-reward ratio of these assets. Stock markets are negatively affected by this. However, it is crucial to make sure that we earn positive net real interest rates, which are returns on investments that have been adjusted for inflation and taxes. We shouldn't choose fixed-income products if inflation is larger than the interest earned.

As previously indicated, when inflation is strong, loan interest rates rise, making it more expensive for businesses to borrow money and spend it. The cost of capital (combined cost of equity and debt) for businesses rises as loan interest rates rise. Therefore, the estimated cash flows are regarded less highly. Since expected cash flows are discounted when valuing equity stocks, an increase in the discounting rate will lead to lower equity valuations. Businesses with a lot of debt suffer the hardest during this time.

How does inflation affect share prices?

Three factors, including business profitability, consumer spending, and the overall economy, all have an impact on equity prices.

Organizational performance

Similar to how it raises the cost of groceries, inflation raises the price of the inputs used in production, such as raw materials, labor, and overhead. Companies have decreased profit margins as a result of rising input costs, which has a detrimental effect on stock values.

Consumer spending

Consumers frequently don't have as much money to buy as many consumer discretionary things as normal since inflation lowers their purchasing power. Consequently, declining demand for the products and services that businesses sell results in decreased corporate revenue and lower net profits.

Overall economy

When inflation reaches this stage, both acute and chronic, the central bank steps in by increasing interest rates. That makes borrowing more expensive. Corporate willingness to take on loans and deal with ever-expensive debt servicing tends to decline as borrowing costs rise.

Expectations

The psychological component follows. Investors view the present value of future cash flows from the stock to be lower due to these effects of inflation. Stock prices, at least in the short term, are largely determined by investor expectations. If investors believe that future cash flows have a lower current value than they do, they will respond in a way that lowers stock prices. Consequently, stock prices decline.

How do you respond to inflation?

Investors should reassess their investment approach and the particular securities in their portfolio in light of inflation.

Value investing

Value investing is the type of investment that typically performs admirably during inflation. Worth investing, as opposed to growth investing, involves finding companies whose intrinsic value, as assessed by fundamental analysis, significantly trails their share price and purchasing them. Value stocks frequently have a good free cash flow and a low price-to-earnings ratio.

Growth investing has outperformed value investing for more than ten years. That results from the Federal Reserve's policy of easy credit. The Federal Reserve lowered interest rates to nearly zero in December 2008 and maintained them there throughout the period of financial crisis recovery. The Federal Open Market Committee did not raise the target federal funds rate above the 0% to.25% range from December 2008 till December 2015. In an effort to lower longer-term interest rates and boost economic activity, the Federal Reserve increased its purchase of longer-term securities during this time.

The target rate returned to being low at the start of the COVID-19 pandemic but rising substantially in the years that followed, reaching 2.25% to 2.50% in late 2018. In reaction to the financial chaos the pandemic caused, the Federal Reserve cut interest rates twice in March 2020, bringing the target federal funds rate back down to between 0% and 0.25%. Since then, it's stayed close to zero.

But with up to three Fed rate increases anticipated in 2022, the age of free credit may be coming to an end. For growth companies, this is bad news, but for value stocks, it's fantastic news.

Inflation Hedges

There are various different securities kinds that function well as inflation hedges in addition to choosing a value investing approach. Numerous recommended lists include small-cap, dividend growth, consumer staples, financial, and energy stocks. The post-pandemic industries that are rebounding, particularly those in travel, leisure, and hospitality, are also being praised.

Another tried-and-true inflationary hedge is real estate. Particularly for 2022, residential real estate is viewed as a safe refuge. Building supplies and home construction are also being advocated as anti-inflation measures. A way to invest in real estate without actually purchasing homes is through real estate investment trusts (REITs), publicly traded businesses that own real estate or mortgages.

One of the most effective ways to protect against inflation may be to invest in commodities. Agriculture products and raw resources can be exchanged like securities. Among other things, commodities merchants frequently buy and sell meat, coffee, grain, natural gas, oil, and other precious metals. Through the use of futures and options contracts, investments in exchange-traded funds, and mutual fund holdings, investors can allocate a portion of their portfolios to commodities.

Indexes of inflation

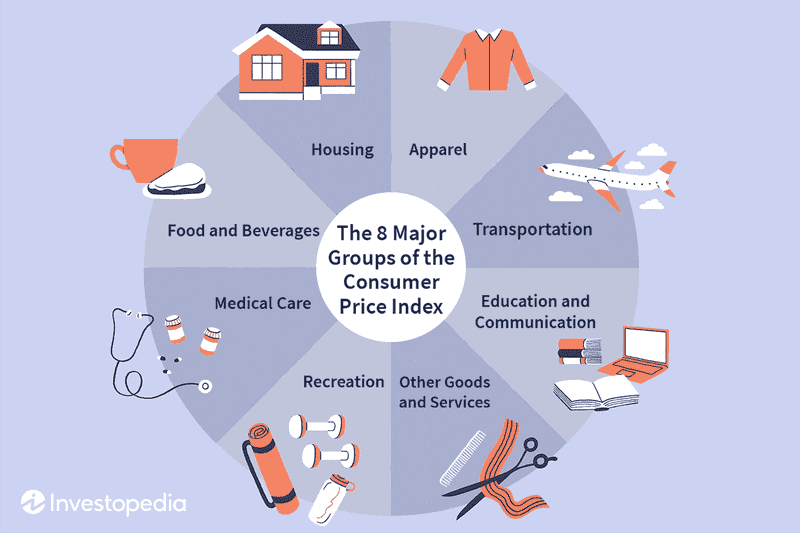

There are two main methods for monitoring inflation: the Consumer Price Index (CPI), which is geared toward consumers, and the Wholesale Price Index (WPI), which is geared toward wholesalers (PPI).

Consumer Price Index

The CPI is used by the U.S. Bureau of Labor Statistics to calculate inflation. By examining price rises (or decreases) for goods and services across a range of industries, the CPI is calculated. Food and beverage, housing, clothes, transportation, education & communication, recreation, healthcare, and other goods and services are the primary industries that are taken into account in this computation.

Since 1913, the Bureau of Labor Statistics has tracked and reported on the cost of living using the CPI.

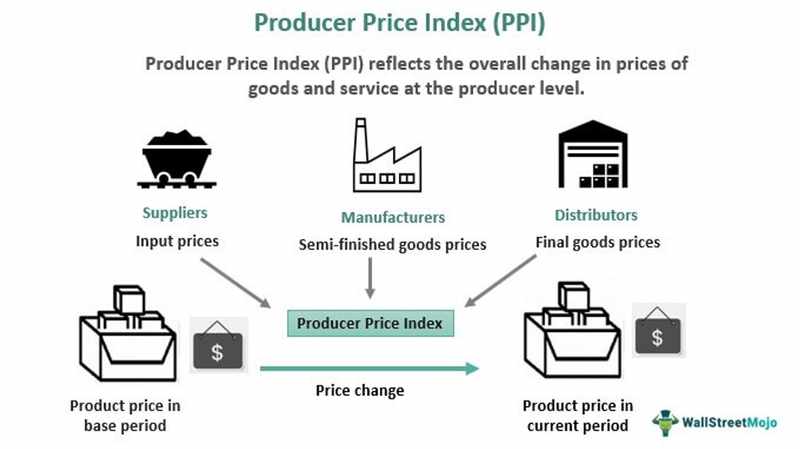

Producer Price Index or Wholesale Price Index

In that it records changes in product prices, a wholesale price index (WPI) is similar to the consumer price index. WPI, however, tracks changes at the wholesale level rather than tracking price changes at the consumer level like CPI. Instead of from a firm to the consumer, it follows the price of items sold in bulk from one company to another.

Up until 1978, the US employed a wholesale price index. Following then, the name was changed to the Producer Price Index (PPI). While PPI is calculated similarly to WPI, it also takes service pricing into account.

The Bureau of Labor Statistics tracks and publishes monthly reports on the Producer Price Index.

Inflation rates in the recent years

Economists calculate the rate of inflation for the previous 12 months each year. We can anticipate that this amount will vary from year to year depending on the state of the economy. The rate of inflation has been largely stable over the last few years.

For instance, the inflation rate for 2019 was 1.81%, which means it would cost about 2 cents more to purchase the same basket of goods and services at the year's end as it would have at the start.

2020 saw an inflation rate of 1.2%. 4.7% was the inflation rate in 2021. The expected inflation rate for 2022 is 6.1%.

The figures we've covered relate to the dollar generally, but state and city-level inflation rates can also differ.

Although it has recently started to pick up speed in the United States, this has not always been the case.

In 1947, the United States inflation rate reached a record high of 14.0%. In 1921, it dropped as much as 11%. Deflation is the state in which inflation is negative, or when a dollar or other currency can suddenly buy more goods and services than it could previously. Over the past 50 years, prices have typically risen rather than fallen.

Hyperinflation is the term used to describe significant increases in inflation.

A period of significant inflation or deflation is typically brought on by a large economic event.

Market bullishness and bearishness frequently coincide with periods of inflation and deflation. Inflation is more likely to occur during a bull market, while deflation is more likely during a bad market.

Inflation's benefits and drawbacks

Most of us only consider inflation to be a bad thing because it indicates that prices are rising. While there are drawbacks to inflation, there can also be positive aspects.

Pros

First of all, moderate inflation indicates an expanding economy. It is typical for inflation to increase a little when the economy is doing well.

Inflation also has another advantage, which most consumers would likely consider positive. The price of debt rises when the value of a dollar falls. Your monthly loan payments may consume a lesser portion of your income as a result of the fact that incomes normally increase along with inflation.

Cons

The negative effects of inflation may be more obvious. A dollar loses purchasing power due to inflation, which also raises the price of goods and services.

Even though growing prices are annoying at all times, they can be particularly problematic when salaries don't increase at the same rate as inflation.

Savings and retirement accounts may also suffer from inflation. Your savings may not last as long after you retire since they aren't worth as much as they did when you first started them.

The bottom line

The historical pattern demonstrates that times of rising inflation are associated with comparatively poorer stock market performance. Does this thus imply that growing inflation is detrimental to the economy? Actually, no. Ironically, history shows that increasing inflation rates are typically associated with increasing Gross Domestic Product (GDP). In reality, very low inflation rates might hinder economic progress. Japan, which is working to increase its inflation, maybe the finest illustration of this.

Rising inflation should, however, stay within predetermined goals. When inflation exceeds targets for an extended period of time, the economy may become unbalanced. Take the current economic situation in Sri Lanka, where inflation reached a record-high 54.6% in June 2022. In addition, the government's foreign exchange reserves are at an all-time low, and citizens there are having trouble paying for even the most basic necessities like food, medicine, and fuel.

We can therefore draw the conclusion that, despite certain potential negative effects, rising inflation is necessary for economic development. Interest rates may increase in unison with rising inflation. Since lower stock market returns are most certainly associated with higher interest rates, this largely explains why the stock markets are currently declining.

Additionally, keep in mind the adage that "inflation is a quiet killer." Therefore, one must maintain constant vigilance and have the proper balance of equity and debt assets.

FAQ

How does Russia’s attack on Ukraine affect inflation?

Russia is a significant energy producer, thus it is likely that the flow of oil and natural gas to the international markets will now be uncertain for some time. The price of oil has already increased due to this diminished supply, reaching levels not seen since 2008. Higher energy prices around the world will undoubtedly have an impact on our domestic economy, adding to the agony at the gas pump and raising the cost of operations and the goods they create. Additionally, Russia and Ukraine jointly produce around one-third of the wheat exported worldwide3, meaning that the already high prices of groceries over the previous year will continue to rise under additional pressure. However, despite the possibility that tensions in Europe would increase volatility and inflationary pressure in the short term, your long-term investment strategy shouldn't be affected.

How does inflation impact bond and cash yields?

Because of what it entails for cash and bonds, inflation is another factor about which we need to be very careful. Inflation can swiftly devalue cash positions given the current low-interest rates and nearly nonexistent income on savings accounts. Bonds and other fixed-income assets can perform poorly during periods of rising inflation. Real returns, which often relate to the difference between an investor's interest rate and the rate of inflation, are one idea to be familiar with. For instance, if inflation is 7% but a 10-year federal bond pays 2% interest, the implied "real return" is -5%. That bond's value can decrease as a result of this. The Federal Reserve may also put in place policies that raise interest rates throughout the economy to combat increasing inflation. Bond prices may decline as a result of higher interest rates, and bond mutual funds may even experience a loss of value.

How does inflation affect the value and growth stocks?

Value and growth stock segments are frequently used to categorize stocks. Growth stocks are likely to represent rapidly expanding, potentially unprofitable enterprises, whereas value stocks, which have good current cash flows, are more likely to grow slowly or decline over time.

Growth stocks are therefore adversely affected by rising interest rates far more than value stocks when assessing firms using the discounted cash flow technique. Growth stocks will suffer more during periods of high inflation since interest rates are typically raised to combat high inflation.

How do you calculate inflation?

You can use the U.S. to determine the inflation rate for any certain year. CPI Inflation Calculator from the Bureau of Labor Statistics (BLS). You can use this calculator to determine how much a dollar has changed in value during a certain time period.

The BLS calculates the rate of inflation using the formula below:

Increase in Inflation = Final CPI Index Value / Beginning CPI Value

How can you invest for inflation?

Inflation can have a significant negative impact on savings and retirement funds.

Here is an illustration for you:

Consider depositing $100,000 into a savings account. Let's also assume that the cumulative rate of inflation in 20 years will be 50%. You will have lost money in actual dollars if your savings have not increased by 50% as well.

Investing in stocks is one method of hedging against inflation. This is due to the fact that the stock market often appreciates in value along with inflation. (Investments always include risk; investment returns are never guaranteed.)

Of fact, the stock market could collapse for a considerable amount of time, and the economy could face deflation over the medium to long term, making the money in your savings account more valuable in real terms, though this has historically been rare.

Purchasing Treasury Inflation-Protected Securities is another approach to investing in inflation protection (TIPS). TIPS are low-risk bonds that are indexed to inflation, so if inflation rises, you won't lose money.