What is portfolio rebalancing?

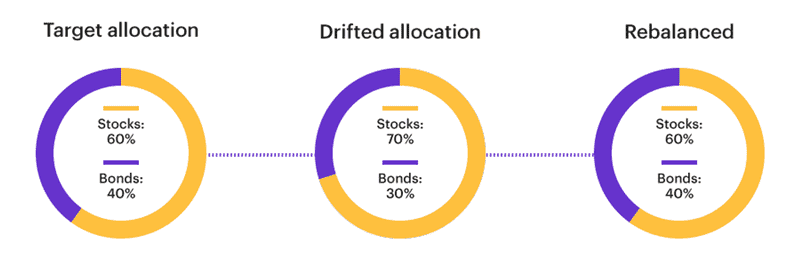

Rebalancing is the process of bringing the asset allocation values of a portfolio back to the levels specified by an investment strategy. These levels are meant to correspond to an investor's appetite for risk and potential rewards.

Asset allocations might fluctuate over time when market performance changes the assets' worth. To restore and maintain the initial, targeted level of asset allocation, rebalancing entails regularly buying or selling the assets in a portfolio.

Consider a portfolio that was initially intended to have a 50% stock and 50% bond asset allocation. If the value of the stocks increased over a specific time period, their allocation percentage within the portfolio might rise to, say, 70%. The investor may then choose to realign the percentages back to the original goal allocation of 50%–50% by selling some stocks and purchasing bonds.

How does it work?

Rebalancing a portfolio tries to give investors exposure to rewards while shielding them from unfavorable risks. Additionally, it can guarantee that the exposure of a portfolio stays within the manager's sphere of expertise.

A stock's price performance may occasionally fluctuate more sharply than a bond's. Therefore, as market conditions change, it is important to evaluate the proportion of equity-related assets in a portfolio. A rebalancing may be necessary if the value of the stocks in a portfolio leads their allocation to exceed the predetermined percentage. Reducing the total percentage of stocks in the portfolio would entail selling some shares of stock.

In order to adapt their overall portfolio risk to changing financial needs, investors may also wish to do so. For instance, an investor who requires a bigger return potential can increase the allocation in riskier assets, like stocks, to increase that possibility. Alternately, if income starts to matter more than it did previously, the allocation of bonds might be raised.

Rebalancing is sometimes wrongly understood by investors to mean adjusting for an even distribution of assets. A stock and bond split of 50/50 is not necessary, though. Target asset allocation for a portfolio could equally well be 10% cash, 40% stocks, 50% bonds, or 70% stocks and 30% bonds. The distribution is determined by the demands and ambitions of the investor.

We've talked about portfolio rebalancing in terms of percentages thus far. Let's examine a straightforward financial scenario so that you may more clearly comprehend how rebalancing functions.

Let's imagine you decide to create a portfolio that is quite conservative, with a 50/50 mix of stocks and bonds. You allocate $2,500 to each asset class out of a total investment of $5,000.

Your stocks have doubled in value to $5,000 at the end of the year. Despite the $7,500 value of your portfolio, your allocations have changed.

Your overall investments now consist of more than 66% stocks and only 34% bonds. You would then need to reallocate the $1,250 of the gain into high-performing equities and use the money to purchase more bonds in order to rebalance this portfolio at its initial 50/50 split.

Your $7,500 portfolio now consists of $3,750 in bonds and $3,750 in equities.

A guideline for portfolio rebalancing

Your transaction costs, personal preferences, and tax considerations, such as the type of account you are selling from and whether your capital gains or losses will be taxed at a short-term or long-term rate, will all affect how frequently you should rebalance your portfolio. According to your age, it also varies. For instance, you might not want to rebalance your portfolio as frequently when you are relatively young, say in your 20s and 30s, and need to maximize your gains. Generally, once a year is sufficient; however, longer periods might also be appropriate if some of the assets in your portfolio haven't seen a significant increase this year.

Additionally, adjustments to an investor's asset-allocation strategy may be necessary due to changes in their way of life. Whatever your preference, the fundamental steps for rebalancing your portfolio are as follows:

- Record: Keep a record of the total cost of each security at that time, as well as the total cost of your portfolio, if you recently decided on an asset-allocation strategy that seems ideal for you and bought the appropriate securities in each asset class. These figures will give you historical information about your portfolio so that you may later compare it to current values.

- Compare: Examine the present worth of your portfolio and each asset class at a predetermined period in the future. Divide the current value of each asset class by the overall current portfolio value to determine the weightings of each fund in your portfolio. Contrast this number with the initial weightings. Are there any notable alterations? If not—and if you have no immediate need to liquidate your portfolio—it could be preferable to stay passive.

- Adjust: Multiply the current total value of your portfolio by each of the (%) weightings previously given to each asset class if you discover that changes in your asset class weightings have affected the portfolio's exposure to risk. The amounts you determine are what you should invest in each asset class to keep your original asset allocation intact.

Of course, you might desire to sell securities from asset classes with excessive weights and buy more securities in classes with decreasing weights. Consider the tax repercussions of your portfolio adjustment before selling any assets to balance your portfolio.

In some circumstances, it may be more advantageous to simply stop making any new contributions to the asset class that is overweight while continuing to make contributions to other underweighted asset classes. Over time, your portfolio will rebalance without your having to pay capital gains taxes.

When should your portfolio be rebalanced?

Investors are advised to review allocations at least once a year, however, there is no set timeframe for rebalancing a portfolio. Investors are not required to rebalance, although it is typically not a good idea.

Rebalancing gives investors the chance to sell high and buy low by reinvesting the profits from high-performing investments in sectors that are anticipated to experience significant growth.

An investment plan, which specifies asset allocations and rebalancing, can be as simple as an individual's idea or strategy or as complex as a multipage document generated by a portfolio manager. An investment strategy may ensure that every investor performs the necessary procedures, such as rebalancing, and stays away from ineffective actions that might have a detrimental impact on a portfolio's performance.

The different ways to rebalance your portfolio

Calendar Rebalancing

The simplest method of rebalancing is calendar rebalancing. This tactic entails reviewing and modifying the portfolio's investment holdings at predetermined intervals.

A lot of long-term investors perform rebalancing once per year. Other categories of investors may rebalance on a quarterly or even monthly basis depending on their outlooks and objectives. Rebalancing on a weekly basis could be overly costly and pointless.

Based on an investor's time restrictions, the threshold for transaction costs, and allowance for value drift, the appropriate frequency of rebalancing must be chosen. Since there are fewer rebalancing occasions and possibly fewer trades, calendar rebalancing has the advantage of being less time- and money-consuming for the investor than more responsive approaches. One drawback is that, even if the market changes dramatically, it does not require rebalancing on other occasions.

Constant-Mix Rebalancing

Rebalancing strategies that are more responsive place greater emphasis on the permissible percentage composition of each asset in a portfolio. A constant-mix method using bands or corridors is what this is.

There is a goal weight and a corresponding tolerance range assigned to each asset class or individual security. For instance, an allocation strategy might mandate holding 40% of government bonds, 30% of domestic blue chips, and 30% of developing market equities, with a +/- 5% range for each asset class.

As a result, ownership in domestic blue chip companies and emerging market companies can both change by 25% to 35%. Government bonds must make up between 35% and 45% of the portfolio at the same time. The entire portfolio is rebalanced to match the initial target composition when the weight of anyone holding moves outside of the permissible zone.

Constant Proportion Portfolio Insurance

Constant Proportion Portfolio Insurance (CPPI), a sort of portfolio insurance that enables the investor to put a floor on the dollar value of their portfolio and shape the asset allocation on it, is the most intense rebalancing approach frequently employed.

A risky asset, like stocks or mutual funds, and a conservative asset, such as cash, cash equivalents, or treasury bonds, are how the asset classes in the CPPI are structured.

The portion allotted to each is determined by a multiplier coefficient and a cushion value, which is the current portfolio value less a certain floor value. The rebalancing approach is more aggressive with a higher multiplier value.

The CPPI strategy's result is roughly comparable to purchasing a synthetic call option without using genuine option contracts. CPPI is occasionally described as a convex technique.

Smart Beta Rebalancing

Smart beta rebalancing is a regular rebalancing process that indexes go through to adapt to changes in stock price and market capitalization.

By using a rules-based approach, smart beta methods stay clear of the market inefficiencies that arise from index investing's reliance on market capitalization. Smart beta rebalancing distributes the holdings across a number of equities using additional criteria, such as value as determined by performance indicators like book value or return on capital.

The addition of a layer of systematic analysis to the investment that basic index investing lacks is provided by this rules-based approach to portfolio construction.

Smart beta rebalancing is more active than just mimicking the market with an index, but it is less active than stock selecting. Emotions are removed from the process during smart beta rebalancing, which is one of its main advantages.

An investor may reduce exposure to their top performers and increase exposure to less impressive performers, depending on how the rules are set up. This goes against the conventional wisdom that says you should let your winners run, but regular rebalancing results in profits rather than trying to time market sentiment for maximum gain.

If the right settings are applied, smart beta can also be used to rebalance between asset classes. In this situation, comparing various investment types and adjusting exposure as necessary typically involves using risk-weighted returns.

Examples of portfolio rebalancing

Rebalancing Retirement Accounts

The allocations in investors' retirement accounts are one of the most popular areas they look to rebalance. A lot of investors prefer to invest more aggressively when they are younger and more conservatively as they get closer to retirement age because asset performance affects the overall value.

When the investor is getting ready to withdraw money to provide retirement income, the portfolio is frequently at its most conservative. A portfolio may therefore be rebalanced over time to reflect an increased allocation to fixed-income securities.

Rebalancing for Diversification

Investors might discover a significant amount of assets concentrated in one location, depending on market performance. For instance, if stock X's value rose by 25% but stock Y's rose by just 5%, a sizable portion of the portfolio's worth would be dependent on stock X.

If stock X experiences a sharp decline, the portfolio will consequently sustain more losses. By rebalancing, an investor can move some of the money that is now invested in stock X to another investment, whether it be additional stock Y or the acquisition of a brand-new stock.

By distributing money among several equities, a decline in one will be somewhat offset by the performance of the others, resulting in a certain amount of portfolio stability.

Pros and cons of portfolio rebalancing

Pros

- Rebalancing helps investors maintain portfolios that reflect their risk appetite and need for a specific rate of return.

- It upholds an asset allocation that has been predetermined and specified by an investment plan.

- It is a methodical, emotionless approach to investing that might lessen risk exposure.

- It may be modified when investors' financial requirements and investing objectives alter.

- Rebalancing can be carried out by portfolio managers or skilled individual investors.

Cons

- Transaction expenses associated with rebalancing could lower net income.

- In order to rebalance a portfolio, selling stocks that have appreciated in value could cause investors to lose out on the rising price trend of those securities.

- To adequately decrease exposure to risk and rebalance as necessary, investing knowledge and experience are essential.

- Unnecessary rebalancing might raise an investor's costs.

An imbalanced portfolio

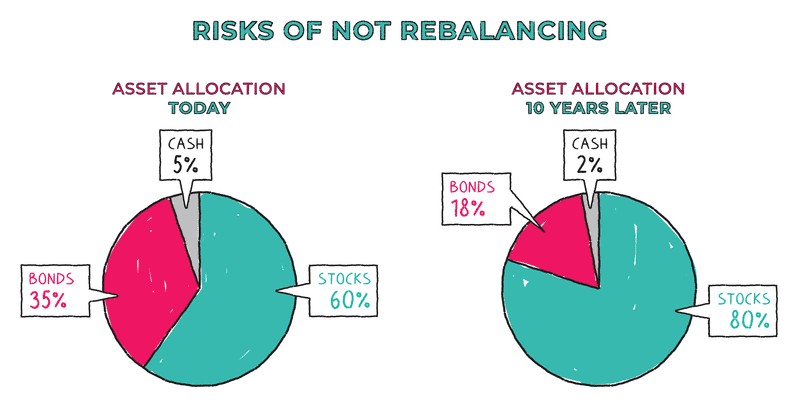

Many investors have the common notion that if an investment has performed well in the past year, it will likely continue to do so in the future. Unfortunately, previous success does not always predict future performance, which is something that many mutual funds make clear.

If all of your investments are in target-date funds or funds that automatically rebalance, you might not need to rebalance your portfolio.

However, many investors continue to hold significant positions in the winning fund from the previous year and may reduce their portfolio proportion in the losing fixed-income fund. But keep in mind that equities are more volatile than fixed-income securities, so big gains from the previous year might turn into losses in the following one.

The equity fund would increase more, and the ignored portfolio may experience a greater value increase than the bond fund if the stock market rallies again throughout the second year. Similar to many hedging techniques, the upside potential may be constrained, but by rebalancing, you are still maintaining your degree of risk tolerance.

While risk-averse investors, who favor the security provided by Treasury and fixed-income funds, are willing to accept limited upside potential in exchange for greater investment security, risk-loving investors are able to tolerate the gains and losses associated with a heavy weighting in an equity fund.

Defining crypto portfolio rebalancing

Rebalancing a crypto portfolio works in a manner akin to that of a traditional portfolio. A crypto portfolio, however, merely consists of a variety of various cryptos, such as Bitcoin (BTC), Chainlink (LINK), Ethereum (ETH), Dash (DASH), and others, as opposed to stocks and fixed income.

There are two main methods for rebalancing a crypto portfolio:

- Threshold Rebalancing: Similar to traditional portfolios, threshold rebalancing happens when the weight of an asset surpasses a set threshold. For instance, if a trader's objective threshold is +/- 10% and their portfolio is split equally between BTC and ETH, BTC climbing to 60% would indicate that the portfolio has to be rebalanced.

- Periodic Rebalancing: Contrarily, with frequent rebalancing, traders have the freedom to change their portfolios as they see fit. Considering the heightened volatility of the cryptocurrency market, rebalancing may benefit from a more consistent strategy.

How often should a crypto portfolio be rebalanced?

Despite the well-known volatility of cryptocurrencies, regular rebalancing might result in large gains.

Increasing the frequency of rebalancing directly improved portfolio performance, according to a recent study. In fact, the HODL (hold on for dear life) strategy was defeated in 92% of all portfolios that continuously rebalanced over the course of a year. Rebalancing crypto portfolios outperformed HODL on average by 64%.

Since then, additional recent research has verified that portfolio performance for cryptocurrencies generally gets better with more frequent rebalancing.

In summary

There are strong arguments for both sides when it comes to rebalancing portfolios. Rebalancing is defended by its proponents as a way to lower risk and protect against volatility, while its opponents criticize it as a too straightforward tactic.

These critics cite the popular stock market index funds and ETFs as proof that rebalancing is still not necessary.

In the end, portfolio rebalancing is based on your particular financial situation. Younger investors who plan to work for many years may be able to manage a riskier portfolio with longer rebalancing intervals.

Rebalancing, though, can provide more immediate profit if you're a more cautious investor or are already retired.

FAQ

What does it mean to rebalance a portfolio?

It involves making the necessary purchases and sales of assets to return the value of each allocation in a portfolio to the level predetermined by an investment strategy.

Are there costs involved in portfolio rebalancing?

It does, indeed. It involves the costs associated with buying and selling shares. It might also be related to performance costs. For instance, you might sell securities that have appreciated in value and tipped your allocations out of whack in order to rebalance. You might lose out on a future increase in price for those securities, though. You can be aware of (and ready to accept) these and other potential fees in advance by including rebalancing in an investment strategy that you commit to.

How often should your 401(k) be rebalanced?

The frequency of rebalancing an individual's investment portfolio, including their 401(k), depends on a range of variables, including age, risk tolerance, wage allocation, and more. Although once a year is a plenty, experts advise that people adjust their 401(k) investments every quarter.

How can taxes be avoided when rebalancing a portfolio?

Selling any investments during portfolio rebalancing will result in taxes being due. Taxes must be paid by the investor when they sell investments they have profited from. An investor will be charged tax based on their regular income tax band if their investments are sold within a year. After a year, investments that are sold will be subject to capital gains tax, which is less than regular income tax. An investor can prevent this by rebalancing their portfolio by acquiring more securities in the undervalued asset class.

Placing your portfolio in a tax-advantaged account, such as an individual retirement plan, is another approach to avoid paying taxes (IRA). By doing this manner, you can rebalance your portfolio without paying taxes and only pay taxes after you start taking money out of the account.

Why is it considered important to rebalance your portfolio?

The weighting of each asset class in your portfolio will fluctuate over time based on the performance of your assets, which will modify the risk profile of your portfolio and necessitate periodic rebalancing. Rebalancing is a crucial procedure to make sure your portfolio is constructed in a way that complies with your investment plan and risk profile.