ACM ResearchACMR

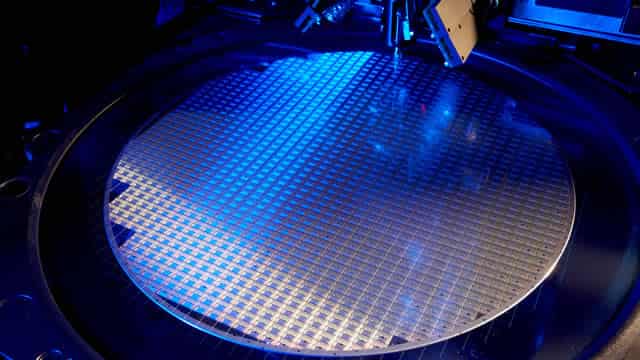

About: ACM Research Inc supplies advanced, innovative capital equipment developed for the global semiconductor industry. Fabricators of advanced integrated circuits, or chips, can use its wet-cleaning and other front-end processing tools in numerous steps to improve product yield, even at increasingly advanced process nodes. It has designed these tools for use in fabricating foundry, logic and memory chips, including dynamic random-access memory, or DRAM, and 3D NAND-flash memory chips. The company also develops, manufactures and sells advanced packaging tools to wafer assembly and packaging customers.

Employees: 2,023

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

33% more funds holding in top 10

Funds holding in top 10: 3 [Q3] → 4 (+1) [Q4]

6.35% more ownership

Funds ownership: 55.62% [Q3] → 61.97% (+6.35%) [Q4]

5% more repeat investments, than reductions

Existing positions increased: 62 | Existing positions reduced: 59

0% more first-time investments, than exits

New positions opened: 35 | Existing positions closed: 35

3% less funds holding

Funds holding: 184 [Q3] → 179 (-5) [Q4]

17% less capital invested

Capital invested by funds: $649M [Q3] → $539M (-$110M) [Q4]

36% less call options, than puts

Call options by funds: $19.6M | Put options by funds: $30.6M

Research analyst outlook

1 Wall Street Analyst provided 1 year price targets over the past 3 months

1 analyst rating

JP Morgan Jimmy Huang 0% 1-year accuracy 0 / 1 met price target | 96%upside $36 | Overweight Initiated | 28 Feb 2025 |

Financial journalist opinion

Based on 6 articles about ACMR published over the past 30 days