ARK Genomic Revolution ETFARKG

ARKG

0

Funds holding %

of 7,407 funds

–

Analysts bullish %

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

16% more first-time investments, than exits

New positions opened: 44 | Existing positions closed: 38

13% more call options, than puts

Call options by funds: $68.2M | Put options by funds: $60.3M

1% less funds holding

Funds holding: 235 [Q3] → 232 (-3) [Q4]

2.87% less ownership

Funds ownership: 54.81% [Q3] → 51.94% (-2.87%) [Q4]

18% less capital invested

Capital invested by funds: $699M [Q3] → $574M (-$125M) [Q4]

57% less repeat investments, than reductions

Existing positions increased: 38 | Existing positions reduced: 88

100% less funds holding in top 10

Funds holding in top 10: 1 [Q3] → 0 (-1) [Q4]

Research analyst outlook

We haven’t received any recent analyst ratings for ARKG.

Financial journalist opinion

Neutral

Seeking Alpha

1 month ago

Seeking Stocks With Vitality In The Volatile Healthcare Sector

Investors cooled to the healthcare sector in 2024, which dramatically trailed global and US equity markets for the year. any investors are now asking: how will the policy changes under a new US administration affect healthcare companies?

Positive

Zacks Investment Research

1 month ago

Best-Performing ETFs of Last Week

Wall Street was upbeat last week, despite the release of hot January inflation data.

Negative

24/7 Wall Street

2 months ago

2 Actively Managed ETFs That Got Smoked by the S&P 500 Last Year

Low-cost passive index investing (in the S&P 500 or Nasdaq 100) has been key to impressive results in recent years.

Positive

ETF Trends

2 months ago

Can Health Care ETFs Aid Your Portfolio?

The Health Care Select Sector SPDR ETF (XLV) was up approximately 6% year-to-date as of January 29. While it is still early days, this performance is already twice as robust as the sector ETF's performance for all of 2024.

Positive

24/7 Wall Street

2 months ago

Cathie Wood's Top Biotech Plays for February

Don't look now, but Cathie Wood of Ark Invest is fresh off an impressive comeback year, with her broader basket of disruptive technology funds posting high double-digit percentage returns.

Positive

ETF Trends

2 months ago

Under-the-Radar Opportunities in ETFs

Over recent years, investors have sought safety within mega-cap tech stocks while searching for alpha within disruptive technology trends like artificial intelligence. Most investors can agree the AI theme has long-term growth potential, and the current market sell-off is a short-term hiccup.

Neutral

ETF Trends

2 months ago

ETF Prime: Islam Shares 2025's Top Trends and ETFs

On this week's episode of ETF Prime, Roxanna Islam, CFA, CAIA, head of sector & industry research at VettaFi, joined host Nate Geraci. The two discussed top ETF performers and trends this year as well as long-established asset managers finally joining the ETF industry.

Neutral

Bloomberg Markets and Finance

2 months ago

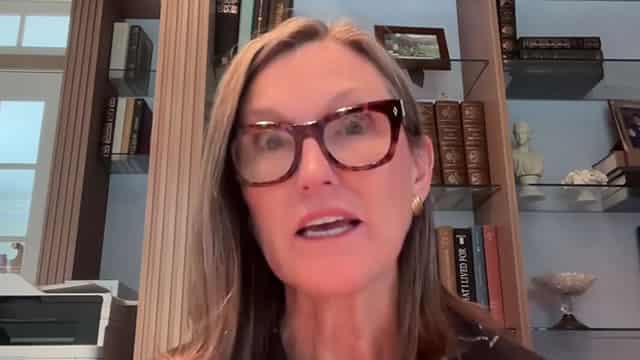

Cathie Wood on DeepSeek, Nvidia, Stock Picks, China, AI

Chinese AI startup DeepSeek has released a new open-source AI model called R1 that can mimic human reasoning, rivalling or outperforming leading US developers on industry benchmarks. The release of R1 has sent shockwaves through the US tech industry, with companies like OpenAI and Meta analyzing how DeepSeek built its model and whether it did so as cheaply as claimed, and lawmakers trying to figure out how to compete with China's progress on AI.

Positive

Seeking Alpha

2 months ago

ARKG: Eyeing Favorable Macro 2025 Turns, Encouraging Momentum Trends

I maintain a buy rating on ARK Genomic Revolution ETF (ARKG) due to improving momentum, potential lower interest rates, and a favorable M&A environment in 2025. Despite a 20% decline in 2024, ARKG's technical chart shows bullish potential with key support at $21-$22 and resistance at $28. ARKG is a small, actively managed ETF focused on genomics, with high exposure to small-cap stocks and a diversified mix of value, blend, and growth.

Neutral

The Motley Fool

2 months ago

Here Are the 6 Largest Stock Holdings in All of Cathie Wood's ETFs Right Now

Asset management company Ark Invest offers nine different investment funds, eight of which are available as exchange-traded funds, or ETFs. They all have a different tech-related focus, such as robotics, biotechnology, or general innovation.

Charts implemented using Lightweight Charts™