ARK Innovation ETFARKK

ARKK

0

Funds holding %

of 7,407 funds

–

Analysts bullish %

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

123% more first-time investments, than exits

New positions opened: 125 | Existing positions closed: 56

54% more capital invested

Capital invested by funds: $2.39B [Q3] → $3.69B (+$1.3B) [Q4]

33% more funds holding in top 10

Funds holding in top 10: 6 [Q3] → 8 (+2) [Q4]

11% more funds holding

Funds holding: 535 [Q3] → 593 (+58) [Q4]

0.44% less ownership

Funds ownership: 42.81% [Q3] → 42.37% (-0.44%) [Q4]

7% less call options, than puts

Call options by funds: $1.78B | Put options by funds: $1.92B

57% less repeat investments, than reductions

Existing positions increased: 106 | Existing positions reduced: 244

Research analyst outlook

We haven’t received any recent analyst ratings for ARKK.

Financial journalist opinion

Based on 10 articles about ARKK published over the past 30 days

Neutral

Proactive Investors

5 days ago

Ark Invest CEO Cathie Wood describes Trump tariff debacle as 'shock therapy'

Cathie Wood has described Donald Trump's sweeping new tariff regime as “shock therapy” that could, paradoxically, clear the path to freer global trade. The founder and chief executive of ARK Invest, a high-profile US investment firm known for backing high-growth tech companies, argued that what looked like the “largest and most regressive tax increase in US history” may end up being a prelude to “serious negotiations” that reduce both tariffs and non-tariff barriers.

Neutral

ETF Trends

1 week ago

Taking Apart the Tariff Impact With ETFs

A large consensus has been to stay the course with long-term portfolio goals despite recent tariff volatility. While this is generally true, short-term fluctuations still matter.

Negative

Barrons

1 week ago

Cathie Wood's Ark, Fidelity, and Royce Funds Get Hit Hardest by Tariffs, Report Says

Morningside found that funds owning small- and mid-cap stocks, or companies with less certain prospects, fared the worst.

Positive

Market Watch

1 week ago

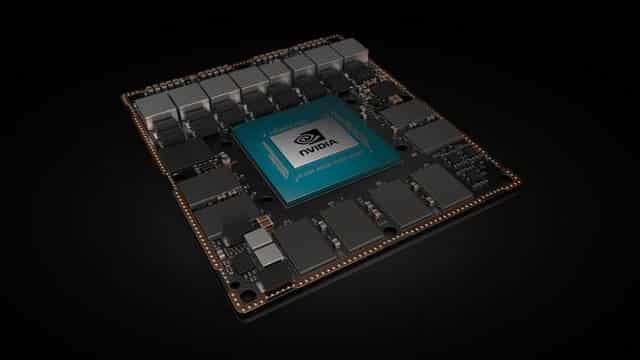

Cathie Wood is finally back to buying Nvidia's stock for her flagship ETF

It took a bear-market plunge in Nvidia Corp.'s stock for famed investor Cathie Wood to once again take a stake in the artificial-intelligence leader within her top fund.

Positive

Seeking Alpha

2 weeks ago

There's Always A Bull Market Somewhere: U.S. ETF Launches Notch A Record

Through the middle of last week - still with a handful of days left in the quarter - 208 new U.S. ETFs were launched in Q1. According to a March Brown Brothers Harriman survey, 95% of investors plan to increase their ETF allocations in the next 12 months. It would not be surprising to see new twists on ESG - climate change, equality, and the state of corporate leadership are issues that could be top of mind going forward.

Negative

24/7 Wall Street

3 weeks ago

1 Top Technology ETF to Buy and 1 to Avoid

The technology-oriented Nasdaq 100 index is back into correction territory, down 10.5% after hitting an all-time high last month.

Neutral

24/7 Wall Street

3 weeks ago

Is Cathy Wood's ARKK ETF a Safe Investment?

Cathy Wood, chief executive of ARKK Invest, is a celebrity in the world of finance.

Positive

The Motley Fool

3 weeks ago

2 Wonderful High-Tech ETFs That Still Look Like Bargains Right Now

After a bit of a rebound, the Nasdaq Composite index is no longer officially in correction territory, for now at least, down by just 9% from the recent highs as of this writing. However, when it comes to finding excellent ETFs, there are still some excellent bargains for long-term investors.

Negative

The Motley Fool

3 weeks ago

1 Technology ETF to Buy Hand Over Fist and 1 to Avoid

With the stock market stumbling in the past month or so, some investors have understandably been looking for the best places to put their money amid the uncertainty. Trade war worries and concerns about an economic slowdown are also fueling investor anxiety.

Positive

Seeking Alpha

4 weeks ago

ARKK's Best Setup In Years: A Case For Outperformance

ARKK's top holdings have shifted, with Palantir replacing Block, and the fund's concentration in its top five holdings has decreased to 38.81%. ARKK has outperformed the Invesco QQQ Trust ETF over the past six months, primarily driven by Palantir's strong performance. ARKK's holdings show strong growth and margin expansion potential, positioning the fund for outperformance relative to the benchmark.

Charts implemented using Lightweight Charts™