AZZ Inc

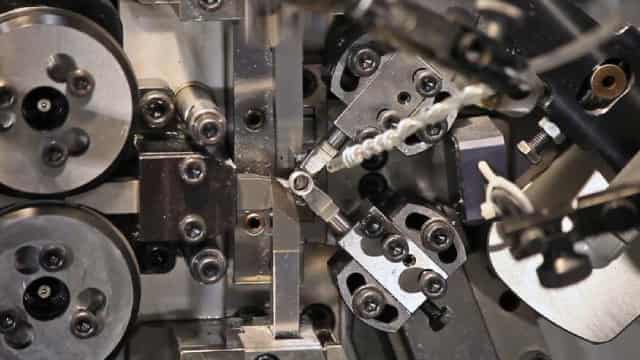

About: AZZ Inc is a provider of galvanizing and a variety of metal coating solutions and coil coating solutions to a broad range of end markets in North America. In its Metal Coatings segment, the company offers metal finishing services to protect against corrosion, such as hot dip galvanizing, spin galvanizing, powder coating, anodizing, and plating. The Precoat Metals Segment offers aesthetic and corrosion-resistant coatings for steel and aluminum coils.

Employees: 3,873

Fund manager confidence

Based on 2024 Q4 regulatory filings by fund managers ($100M+ AUM)

127% more call options, than puts

Call options by funds: $3.19M | Put options by funds: $1.41M

57% more repeat investments, than reductions

Existing positions increased: 96 | Existing positions reduced: 61

0.1% more ownership

Funds ownership: 92.32% [Q3] → 92.41% (+0.1%) [Q4]

0% less capital invested

Capital invested by funds: $2.27B [Q3] → $2.26B (-$11.2M) [Q4]

7% less funds holding

Funds holding: 253 [Q3] → 236 (-17) [Q4]

31% less first-time investments, than exits

New positions opened: 29 | Existing positions closed: 42

33% less funds holding in top 10

Funds holding in top 10: 3 [Q3] → 2 (-1) [Q4]

Research analyst outlook

2 Wall Street Analysts provided 1 year price targets over the past 3 months

2 analyst ratings

Roth MKM Gerry Sweeney 38% 1-year accuracy 6 / 16 met price target | 26%upside $108 | Buy Initiated | 11 Feb 2025 |

B. Riley Securities Lucas Pipes 21% 1-year accuracy 11 / 53 met price target | 30%upside $111 | Buy Maintained | 11 Feb 2025 |

Financial journalist opinion

Based on 19 articles about AZZ published over the past 30 days