Brookfield Infrastructure Partners

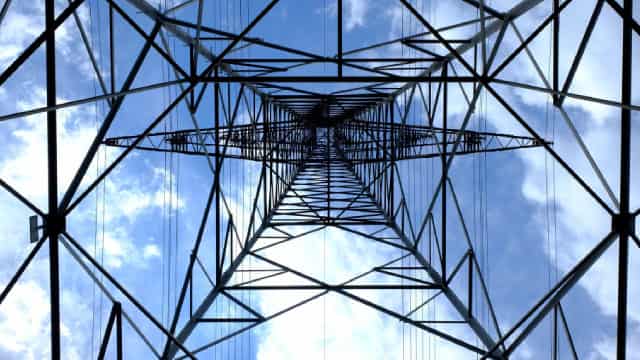

About: Brookfield Infrastructure Partners LP is a Bermuda exempted limited partnership that owns and operates quality, long-life assets that generate stable cash flows, by virtue of barriers to entry or other characteristics that tend to appreciate in value over time. It focuses on acquiring infrastructure assets that have low maintenance capital costs and high barriers to entry. The company's segments consist of Utilities, Transport, Midstream, and Data. Geographically, it generates maximum revenue from USA and also has a presence in Australia, Colombia, United Kingdom, Brazil, United States of America, Chile, Peru, and other countries.

Employees: 61,000

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

1,770% more call options, than puts

Call options by funds: $65.7M | Put options by funds: $3.51M

0.2% more ownership

Funds ownership: 58.66% [Q3] → 58.86% (+0.2%) [Q4]

0% more funds holding in top 10

Funds holding in top 10: 5 [Q3] → 5 (+0) [Q4]

6% less funds holding

Funds holding: 342 [Q3] → 321 (-21) [Q4]

7% less capital invested

Capital invested by funds: $9.39B [Q3] → $8.71B (-$680M) [Q4]

16% less repeat investments, than reductions

Existing positions increased: 87 | Existing positions reduced: 104

26% less first-time investments, than exits

New positions opened: 31 | Existing positions closed: 42

Research analyst outlook

4 Wall Street Analysts provided 1 year price targets over the past 3 months

4 analyst ratings

RBC Capital Maurice Choy 0% 1-year accuracy 0 / 7 met price target | 38%upside $40 | Outperform Reiterated | 25 Mar 2025 |

Scotiabank | 41%upside $41 | Sector Outperform Maintained | 13 Feb 2025 |

TD Securities Cherilyn Radbourne 0% 1-year accuracy 0 / 2 met price target | 83%upside $53 | Buy Maintained | 3 Feb 2025 |

Raymond James Frederic Bastien 20% 1-year accuracy 1 / 5 met price target | 58%upside $46 | Strong Buy Maintained | 22 Jan 2025 |

Financial journalist opinion

Based on 30 articles about BIP published over the past 30 days