DRAG

Roundhill China Dragons ETFDRAG

DRAG

0

Funds holding %

of 7,419 funds

–

Analysts bullish %

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

5.33% more ownership

Funds ownership: 0% [Q3] → 5.33% (+5.33%) [Q4]

81% less call options, than puts

Call options by funds: $51K | Put options by funds: $272K

Research analyst outlook

We haven’t received any recent analyst ratings for DRAG.

Financial journalist opinion

Neutral

PRNewsWire

3 weeks ago

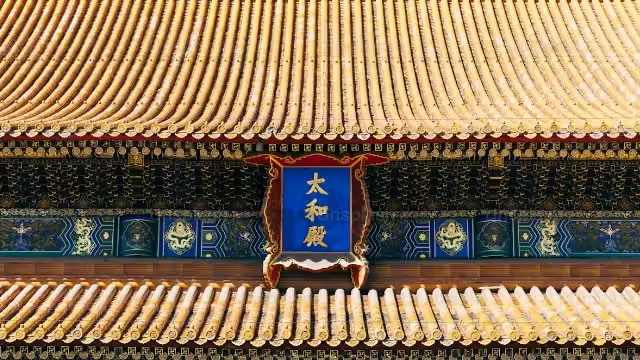

Roundhill China Dragons ETF (DRAG) Announces Strategic Rebalance

DRAG now offers precise exposure to China's six leading tech giants. NEW YORK , March 31, 2025 /PRNewswire/ -- Roundhill Investments, an ETF sponsor focused on innovative financial products, has announced a strategic rebalance of the Roundhill China Dragons ETF (DRAG).

Neutral

ETF Trends

1 month ago

3 Investment Trends in ETFs for 2025

Not even a quarter into 2025 and we've been on a roller coaster of economic and market events. It's the perfect time for the Exchange conference, where advisors, issuers, and other market experts can come together and share ideas.

Neutral

Zacks Investment Research

1 month ago

5 International ETFs Beating the S&P 500 in 2025

After years of underperformance, international ETFs are crushing their U.S. counterparts and having the best start to a year in a century.

Positive

Seeking Alpha

1 month ago

Why Chinese Equities Are Outperforming Wall Street

Has the AI trade moved to China? Why Chinese chipmakers may soon change the semiconductor space.

Positive

ETF Trends

1 month ago

Disruptive Theme of the Week: China ETFs Rallying YTD

One of the top themes year-to-date has been China-focused technology ETFs. China technology stocks have surged on AI enthusiasm related to China startup DeepSeek's AI model launch.

Negative

Seeking Alpha

3 months ago

Hang Seng Index: Transforming Into A Medium-Term Bearish Trend Despite Improving Services PMI From China

Sentiment remains fragile in China and Hong Kong stock market even China services activities have improved in December. Weak market breadth and a persistent bearish trend of the Chinese yuan since November has added to more woes to the Hang Seng Index.

Positive

Seeking Alpha

5 months ago

Where The Money Is Flowing In ETFs After China's Stimulus Package

China's stimulus plan head lead to big fund flows in ETFs. The trend towards private asset ETFs continues to gain steam.

Neutral

CNBC

6 months ago

Hyper-local vs. hyper-focused: Two China ETFs go on different paths

While the Rayliant Quantamental China Equity ETF dives into specific regions, the new Roundhill China Dragons ETF focuses on the country's biggest companies.

Neutral

Bloomberg Markets and Finance

6 months ago

Roundhill Investments CEO on China Dragons ETF (DRAG)

Roundhill Investments CEO Dave Mazza discusses the Roundhill China Dragons ETF (DRAG) and says the idea behind it is to capture the same type of companies the Magnificent Seven represents in the US, but for the Chinese equity market. He speaks with Scarlet Fu, Katie Greifeld and Eric Balchunas on "ETF IQ.

Positive

GuruFocus

6 months ago

Roundhill China Dragons ETF (DRAG) Launches with Focus on Leading Tech Stocks

A new Exchange-Traded Fund (ETF), the Roundhill China Dragons ETF (DRAG, Financial), has been launched to capture the performance of China's leading large-cap companies. The fund tracks an equal-weight basket of 5 to 10 of China's largest and most innovative tech companies, currently including Tencent (TCEHY), Pinduoduo (PDD), Alibaba (BABA), Meituan (MPNGY), BYD (BYDDY), Xiaomi (XIACY), JD.com (JD), Baidu (BIDU), and NetEase (NTES).

Charts implemented using Lightweight Charts™