EQT Corp

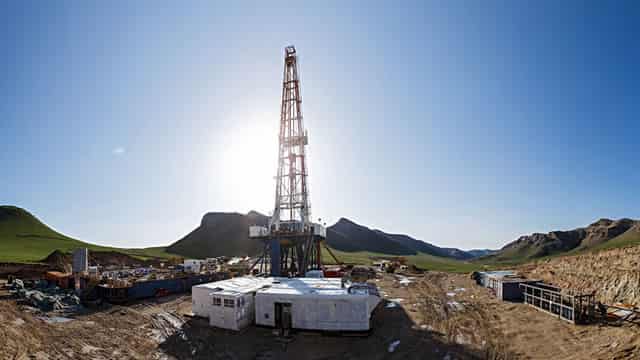

About: EQT Corp is an independent natural gas production company with operations focused in the cores of the Marcellus and Utica shales in the Appalachian Basin, located in the Eastern United States. The firm focuses on executing combo-development projects for developing multiwell pads to meet supply needs, with a focus on maximizing operational efficiency, technology, and sustainability. Its main customers include marketers, utilities, and industrial operators in the Appalachian Basin. The company has one reportable segment and its revenue stems from three types of gas reserves: natural gas, natural gas liquids, and crude oil. All of the firm's operating revenue is generated in the U.S., with most revenue flowing from the Marcellus Shale field and through the sale of natural gas.

Employees: 881

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

278% more first-time investments, than exits

New positions opened: 208 | Existing positions closed: 55

61% more call options, than puts

Call options by funds: $765M | Put options by funds: $476M

31% more repeat investments, than reductions

Existing positions increased: 313 | Existing positions reduced: 239

27% more funds holding in top 10

Funds holding in top 10: 26 [Q3] → 33 (+7) [Q4]

24% more capital invested

Capital invested by funds: $21.9B [Q3] → $27.1B (+$5.24B) [Q4]

19% more funds holding

Funds holding: 726 [Q3] → 866 (+140) [Q4]

2.16% less ownership

Funds ownership: 135.42% [Q3] → 133.25% (-2.16%) [Q4]

Research analyst outlook

10 Wall Street Analysts provided 1 year price targets over the past 3 months

10 analyst ratings

Piper Sandler Mark Lear 34% 1-year accuracy 56 / 166 met price target | 28%downside $35 | Neutral Maintained | 22 Apr 2025 |

UBS Josh Silverstein 14% 1-year accuracy 8 / 58 met price target | 11%upside $54 | Neutral Maintained | 17 Apr 2025 |

Stephens & Co. Mike Scialla 25% 1-year accuracy 13 / 52 met price target | 17%upside $57 | Overweight Maintained | 15 Apr 2025 |

TD Cowen David Deckelbaum 50% 1-year accuracy 2 / 4 met price target | 11%upside $54 | Buy Upgraded | 8 Apr 2025 |

Mizuho Nitin Kumar 26% 1-year accuracy 16 / 62 met price target | 23%upside $60 | Outperform Maintained | 1 Apr 2025 |

Financial journalist opinion

Based on 21 articles about EQT published over the past 30 days