Intuitive MachinesLUNR

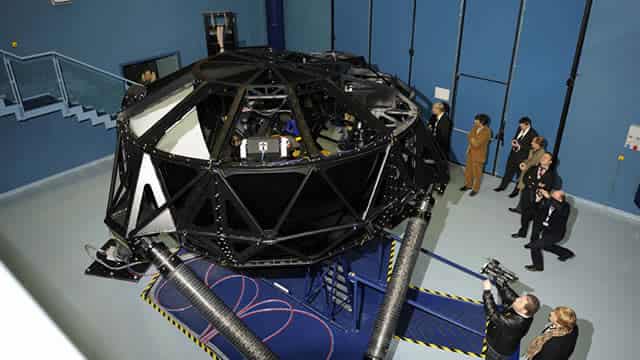

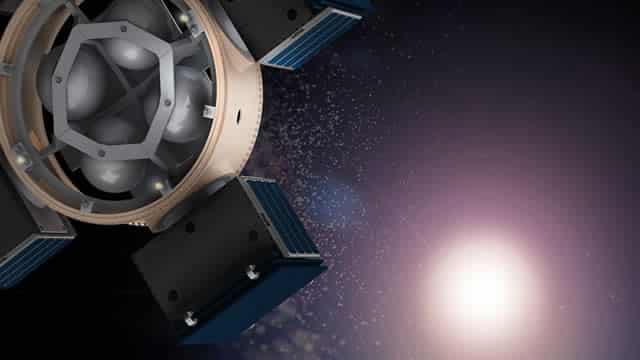

About: Intuitive Machines Inc is a space exploration, infrastructure, and services company. It is a diversified space company focused on space exploration. It supplies space products and services to support sustained robotic and human exploration to the Moon, Mars, and beyond. Its products and services are offered through its four business units: Lunar Access Services, Orbital Services, Lunar Data Services, and Space Products and Infrastructure. The Company operates in one operating segment and one reportable segment underpinned by three core pillars (delivery services, data transmission services, and infrastructure as a service) that have similar capabilities, customers, and economic characteristics. Revenue is from contracts with customers of orbital and lunar access services.

Employees: 435

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

290% more capital invested

Capital invested by funds: $150M [Q3] → $585M (+$435M) [Q4]

195% more first-time investments, than exits

New positions opened: 65 | Existing positions closed: 22

185% more repeat investments, than reductions

Existing positions increased: 57 | Existing positions reduced: 20

112% more call options, than puts

Call options by funds: $190M | Put options by funds: $89.9M

31% more funds holding

Funds holding: 127 [Q3] → 167 (+40) [Q4]

5.95% more ownership

Funds ownership: 29.63% [Q3] → 35.57% (+5.95%) [Q4]

0% more funds holding in top 10

Funds holding in top 10: 2 [Q3] → 2 (+0) [Q4]

Research analyst outlook

5 Wall Street Analysts provided 1 year price targets over the past 3 months

5 analyst ratings

Canaccord Genuity Austin Moeller 12% 1-year accuracy 7 / 58 met price target | 166%upside $21 | Buy Maintained | 25 Mar 2025 |

Cantor Fitzgerald Andres Sheppard 57% 1-year accuracy 81 / 142 met price target | 65%upside $13 | Overweight Maintained | 25 Mar 2025 |

Benchmark Josh Sullivan 58% 1-year accuracy 30 / 52 met price target | 103%upside $16 | Buy Reiterated | 25 Mar 2025 |

Roth MKM Suji Desilva 39% 1-year accuracy 14 / 36 met price target | 52%upside $12 | Buy Maintained | 11 Mar 2025 |

B of A Securities Ronald Epstein 61% 1-year accuracy 20 / 33 met price target | 103%upside $16 | Underperform Initiated | 5 Feb 2025 |

Financial journalist opinion

Based on 19 articles about LUNR published over the past 30 days