RBC Bearings

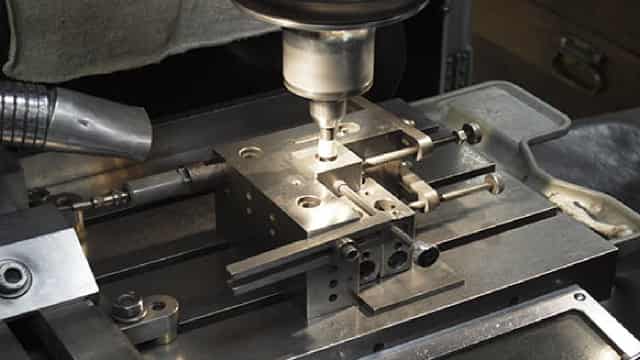

About: RBC Bearings Inc is an international manufacturer and marketer of highly engineered precision bearings, components and essential systems for the industrial, defense and aerospace industries. The offering includes plain bearings, roller bearings, ball bearings, and engineered products. The end market is the United States of America. The company has two reportable segments: Aerospace Defense segment represents the end markets for the company's highly engineered bearings and precision components used in commercial aerospace, defense aerospace, and sea and ground defense applications; and Industrial segment represents the end markets for the company's engineered bearings and precision components used in various industrial applications. It derives maximum revenue from Industrial Segment.

Employees: 5,302

Fund manager confidence

Based on 2024 Q4 regulatory disclosures by fund managers ($100M+ AUM)

41% more first-time investments, than exits

New positions opened: 52 | Existing positions closed: 37

25% more repeat investments, than reductions

Existing positions increased: 159 | Existing positions reduced: 127

3.48% more ownership

Funds ownership: 106.18% [Q3] → 109.66% (+3.48%) [Q4]

2% more funds holding

Funds holding: 384 [Q3] → 392 (+8) [Q4]

3% more capital invested

Capital invested by funds: $9.28B [Q3] → $9.58B (+$298M) [Q4]

13% less funds holding in top 10

Funds holding in top 10: 8 [Q3] → 7 (-1) [Q4]

56% less call options, than puts

Call options by funds: $1.79M | Put options by funds: $4.07M

Research analyst outlook

3 Wall Street Analysts provided 1 year price targets over the past 3 months

3 analyst ratings

Truist Securities Michael Ciarmoli 55% 1-year accuracy 42 / 76 met price target | 20%upside $375 | Buy Maintained | 17 Apr 2025 |

Morgan Stanley Kristine Liwag 57% 1-year accuracy 12 / 21 met price target | 24%upside $390 | Overweight Maintained | 4 Feb 2025 |

Keybanc Steve Barger 13% 1-year accuracy 4 / 30 met price target | 26%upside $395 | Overweight Maintained | 3 Feb 2025 |

Financial journalist opinion

Based on 4 articles about RBC published over the past 30 days