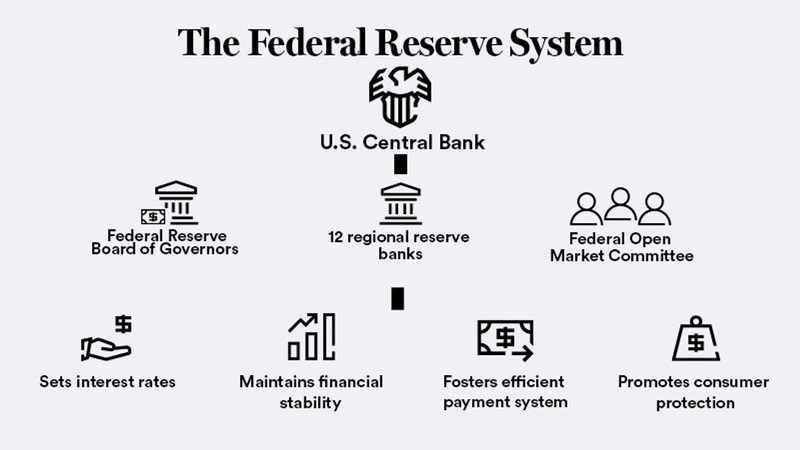

Defining the Federal Reserve

The United States central banking system is the Federal Reserve.

The Fed, which is made up of 12 regional banks, is in charge of setting and carrying out monetary policy, monitoring and controlling financial institutions, and serving as a "lender of last resort" to protect the general stability of the banking and financial system.

The Federal Open Market Committee, or FOMC, the decision-making arm of the Fed, has a "dual mandate," or set of objectives, that it must fulfill in order to have an impact on the economy and therefore the stock market.

- Price stability: The Federal Reserve works to maintain inflation, as shown by annual fluctuations in the PCE and CPI indices of personal consumption expenditures (PCE), at a steady and low target rate of 2% over the long term.

- Maximum employment: Over the long term, the Fed aims to maintain the economy's employment level as high as is sustainably practicable.

What does it do?

Overall, the Federal Reserve executes five primary tasks:

- Manages U.S. monetary policy, which entails measures aimed at achieving its macroeconomic objectives, including price stability and full employment.

- Maintains the stability of the financial system. This implies that despite fluctuating markets, individuals and organizations can save and borrow money.

- Supervises and controls financial institutions, including some state and national banks.

- Provides specific services to banks, including systems for payments and fund settlement.

- Supporters of neighborhood improvement and consumer protection.

Understanding the Federal Fund Rate (FFR)

The federal funds rate is the interest rate that has an effect on the stock market. The discount rate is the interest rate that Federal Reserve Banks charge when they make secured loans to depository institutions, typically overnight, whereas the federal funds rate is the interest rate that depository institutions—banks, savings and loans, and credit unions—charge each other for overnight loans.

In order to keep inflation under control, the Federal Reserve affects the federal funds rate. The Federal Reserve is effectively trying to reduce the amount of money available for making purchases by raising the federal funds rate. As a result, getting money becomes more expensive. On the other hand, when the Federal Reserve lowers the federal funds rate, the money supply rises. This makes borrowing less expensive, which increases spending. Similar trends are followed by the central banks of other nations.

The prime interest rate, which commercial banks charge their most creditworthy clients, is heavily predicated on the federal funds rate, making the federal funds rate significant. It also serves as the foundation for credit card annual percentage rates (APRs), mortgage loan rates, and a variety of other rates for personal and corporate loans.

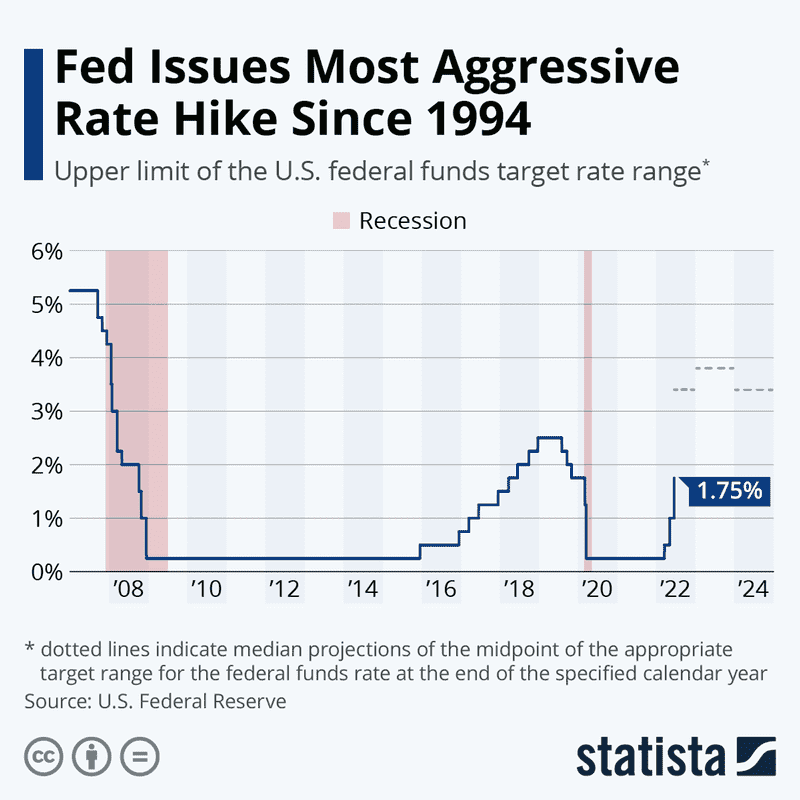

The current FFR

Here are the most recent Fed rates from FOMC meetings:

FOMC meeting dates | Rate change | Fed rate (as a target range) |

Nov. 1-2, 2022. | Increase of 75 basis points (or 0.75%). | 3.75% - 4.00%. |

Sept. 20-21, 2022. | Increase of 75 basis points (or 0.75%). | 3.00% - 3.25%. |

July 26-27, 2022. | Increase of 75 basis points (or 0.75%). | 2.25% - 2.50%. |

June 14-15, 2022. | Increase of 75 basis points (or 0.75%). | 1.50% - 1.75%. |

May 3-4, 2022. | Increase of 50 basis points (or 0.50%). | 0.75% - 1%. |

March 15-16, 2022. | Increase of 25 basis points (or 0.25%). | 0.25% - 0.50%. |

Why is there a target range for the FFR?

Since the Federal Reserve is not involved in the actual lending or borrowing transactions between banks, it is left to any two banks to negotiate the borrowing rate. The Fed encourages banks to borrow money within a predetermined target range. The three rates that the Fed adjusts affect how much interest a bank can receive from the Fed and how much it will cost to borrow money from the Fed. The Fed funds rate rises as the three rates are raised, making borrowing more expensive and, ideally, slowing the economy (and inflation). The converse occurs when the three rates are lowered—borrowing becomes less expensive.

How do the Federal Rate’s policies affect the market?

The Fed's two main monetary policy instruments are as follows, according to Juan Pablo Villamarin, senior financial advisor of Intercontinental Wealth Advisors: "The fed funds rate (FFR), which is the rate at which banks lend and borrow money from one another overnight, is the primary tool and the one that the general public is most familiar with. Open-market operations, or when the Fed buys or sells securities, have been another crucial weapon "He claims.

By affecting how easy or difficult it is to borrow money, changes in the FFR have an impact on the entire economy. The Fed boosted the economy during the COVID-19 pandemic by cutting interest rates to record-low levels. Due to the affordable borrowing options, both consumers and businesses were able to increase their spending and make growth investments.

The outcome was a V-shaped recovery in which the S&P 500 recovered from a sharp decline of more than 20% to hit all-time highs within a short period of time. As investors poured cash into the market, several growth stocks delivered solid returns, attaining high valuations and commanding enormous market capitalizations.

Quantitative easing, a strategy for boosting the markets by buying government bonds and other securities, was also used by the Fed in terms of open-market operations. This increased the amount of money available by giving banks additional liquidity.

Time travel to August 2022. The economy has drastically shrunk after a series of 25-, 50-, and now 75-basis-point increases were made to combat inflation. As a result, the GDP has grown negatively for two consecutive quarters, meeting the technical criteria for a recession.

Businesses that previously had access to inexpensive funding for reinvesting in expansion now face increased borrowing costs as a result of the higher FFR. Due to the lack of cheap interest rates for car loans and mortgages, consumers are forced to cut back on their spending.

Additionally, the Fed is currently reducing the number of assets it buys, which reduces the stimulus to the economy. In an effort to reduce the money supply and increase price stability by battling inflation, the Fed is essentially putting the brakes on economic development. This can lead to significant market volatility, which is what has happened so far in 2022.

The impact of increases in the FFR

- For borrowers: On new loans as well as on existing loans with variable rates, such as credit cards, home equity lines of credit, and small business loans, banks frequently hike the interest rates. The prime rate, which is the lowest interest rate set by each bank for loans to borrowers with excellent credit, is affected by changes in the Federal Reserve's benchmark rate. The prime rate that the Fed announces is based on rates at the majority of the top 25 banks.

- For savers: Rate increases on normal savings accounts and certificates of deposit are possible from banks. Rate rises may entice more people to save money, enabling banks to use more deposits as collateral for lending. In reality, smaller or online-only banks frequently hike savings rates whereas the largest banks hardly ever do. The top CD rates are above 4% APY, and the finest high-yield online savings accounts are above 3% APY.

Why is the Federal Reserve raising interest rates?

In other words, the Fed is thinking about hiking interest rates once more to fight inflation. However, it makes an effort to avoid placing a strain on customers and businesses.

Terrance Grieb, a finance professor at the University of Idaho, claims that the Federal Reserve's activities adhere to a dual purpose. "To guarantee price stability within the economy, as well as to provide a healthy job market," are its two responsibilities.

They are attempting to balance those two things against one another by setting interest rates, a crucial element of monetary policy, he claims.

The interest rate at which banks can borrow money from one another is known as the federal funds rate, and it is set by the Federal Open Market Committee of the Federal Reserve.

By borrowing money at a low-interest rate and then lending it to consumers at a higher rate, banks make money. Modifications to the federal funds rate gradually filter through the financial system and affect interest rates on a range of products, including bonds and mortgages.

Higher interest rates make borrowing money more expensive, which reduces expenditure. This lowers demand across the economy for products and services, which in turn reduces the inflationary price rises.

However, when the Fed raises interest rates, it also runs the danger of slowing down spending too much, which could harm the economy and the stock market in particular.

"Corporations borrow a lot of money to operate their operations every day, and when borrowing money is more expensive, their profits suffer. According to Delia Fernandez, a certified financial planner of Fernandez Financial Advisory in Los Alamitos, California, "And if their profits go down, then their stock is not as attractive."

What is the market expecting from the next FOMC meeting?

According to Grieb, "the markets are obviously anticipating a 0.75% hike in [the Fed's] target for the federal funds rate." He says that stock market values can serve as an indicator of future interest rates and that the S&P 500 and other comparable indices are currently trading at levels that indicate a 0.75 percent hike.

"I believe the markets would respond extremely poorly to a hike of 1% or 1.25%. The value of stocks would drop. And the markets would react very violently if it were merely 0.5%, he adds.

Any choice other than a 0.75% rate increase, according to Grieb, would be unexpected; however, a bigger increase might come as a bit less of a surprise.

Grieb quotes Chairman Powell of the Federal Reserve as saying, "[Jerome] Powell has been fairly explicit that they see the need to be forceful about this."

According to University of Montana finance professor Keith Jakob, if rates increase by the anticipated 0.75%, the market's response may be influenced by what the Fed says about expectations for the upcoming FOMC meeting in early November.

Markets may decline if the Fed gives any indication that additional rises are on the way. However, if it doesn't, markets might increase.

The market may decide to have a relief rally if they say, "OK, let's have a relief rally because we think they're finished rising rates," according to Jakob, if they say, "Yeah, we're doing 0.75% but we think that's enough."

Monetary tools utilized by the Federal Reserve

The COVID-19 pandemic and the Great Recession from 2007 to 2009, in particular, forced the Fed to alter its methods. Here is a summary:

- Open market operations refer to the FOMC purchasing or disposing of Treasury bonds and other U.S. government securities on the open market. Prior to the epidemic, the Fed's primary tool for adjusting the federal funds rate was this instrument. These procedures are being used by the Fed to maintain a large supply of overnight reserves.

- Interest in reserves is the interest rate banks receive on the cash in their accounts at the Federal Reserve Bank for their region. The federal funds rate is mostly moved by the rate. Banks are unlikely to lend money to other banks at a rate below what they earn in interest since they seek a return on their investment.

- The overnight reverse repurchase agreement rate is the interest rate that banks and nonbank financial institutions get on overnight deposits held at the Fed. The following day, the Fed returns all the funds with interest. This rate addresses the issue that nonbank institutions may lend money in the Fed's market at rates below the federal funds rate even though they are not eligible for continued interest on reserves. Simply put, the ON RRP rate serves as the federal funds rate's floor.

- The discount rate is the interest rate charged to banks when they borrow money from the Fed. The discount rate serves as the cap for the federal funds rate because banks typically won't lend at a rate greater than this.

How do investors respond to the Federal Reserve?

It's crucial to remember that markets and investors have an eye on the future. In other words, based on investor expectations, projected future occurrences are "priced in" to the various assets' existing values. Consider how the markets responded to Fed Chairman Powell's announcement of a second consecutive 75-basis-point interest rate hike by sharply rallying over the week of July 25 to July 29.

Given his prior hawkish remarks, most investors in this situation were expecting a significant increase. Markets soared as Powell confirmed the expectation, as the uncertainty subsided. Had Powell announced a 100-point increase, it might have had the opposite effect, shocking investors and wrecking markets as they switched "risk-off."

Chief investment officer at Advyzon Investment Management Brian Huckstep advises against trying to predict and trade around Fed decisions by investors. Investors shouldn't pace the markets, he advises, because the Fed doesn't always operate in the way that people anticipate, leaving them open to unpleasant surprises. The market frequently anticipates what the Fed will do and "front-runs" the anticipated action, causing much of the impact to occur weeks before the actual rate increase.

Having said that, Huckstep does advise that investors with shorter time horizons and lower risk tolerance take the following into account:

- Avoid speculative, volatile assets including small-cap stocks, growth stocks, and cryptocurrencies.

- Hold short-term bonds rather than long- or intermediate-term ones.

- Stocks in the consumer discretionary and technology sectors should be underweighted.

- Think about investing in cash, but don't hold on to it for too long because inflation will erode its worth.

It's important to keep in mind that interest rates won't continue to grow indefinitely for investors with long time horizons. As the economy moves through its many stages, interest rate adjustments will eventually return to normal. For long-term investors, the simplest, most hands-off way to handle Fed rate hikes is to stay the course through turbulence and keep your investments in place.

The Federal Reserve in consumer protection

The Community Reinvestment Act, enacted in 1977 and requiring banks to provide credit to low- and moderate-income households, is one rule that the Federal Reserve Banks make sure banks in their districts follow.

The Dodd-Frank Act, another significant piece of legislation passed by Congress in 2010, strengthened the Fed's structure by establishing the Consumer Financial Protection Bureau as a standalone organization. The CFPB functions as an advocate for anyone who needs to challenge errors on their credit report or complain about their bank and enforces laws, rules, and policies to create a fair and open market for consumer financial services.

Going back to the beginning

To increase the stability of the American financial system, Congress created the Federal Reserve System in 1913 through legislation. The United States was experiencing a series of financial problems at the time, which culminated in the Panic of 1907. Although the Federal Reserve is subject to congressional oversight through audits and testimony, all decisions are made independently. The following three organizations make up the Fed:

Board of Governors

The decentralized network of 12 Federal Reserve Banks is managed by the Federal Reserve Board of Governors, a centralized organization with headquarters in Washington, D.C. The U.S. president nominates and the Senate confirms the seven governors that make up the body.

Reserve Banks

The Reserve Banks oversee a variety of financial institutions, act as the last-resort lender for banks that don't have enough cash on hand and manage wire transfers as well as Automated Clearing House payments for the United States. By managing the U.S. Treasury account for the purpose of processing payments and other transactions, the Reserve Banks furthermore function as the government's bank.

Boston, New York, Philadelphia, Cleveland, Richmond, Virginia, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Missouri, Dallas, and San Francisco are the 12 U.S. cities where Reserve Banks are located. With a few changes over time, the district lines of each Reserve Bank conform to trade routes from 1913. Their regional distinctions may influence how the Fed formulates its policies.

Federal Open Market Committee

The FOMC sets monetary policy to encourage stable prices and economic growth, including maximum employment. One example of this is via adjusting the Fed funds rate. The FOMC is composed of five presidents of Federal Reserve Banks and seven members of the Board of Governors.

FAQ

How is the FFR determined?

During its sessions, the Federal Open Market Committee chooses whether to increase, decrease, or leave the Fed funds rate steady. The FOMC meets eight times a year, and at each one, it discusses its position on the present and upcoming state of the economy and justifies rate changes.

How is the market impacted when interest rates rise?

Growth stocks rely primarily on money for potential future corporate growth. Growth stocks thrive during times of low-interest rates since capital can be acquired at a low cost and growth is easier to come by. Therefore, many investors think that growth stocks become less attractive as interest rates rise since their capacity to secure low-cost debt financing is more challenging and their long-term discounted cash flow is lowered.

In summary, how does the Federal Reserve impact the market?

As a general rule, the stock market rises when the Federal Reserve lowers interest rates; the stock market declines when the Federal Reserve raises interest rates. However, there is no assurance as to how the market will respond to any particular adjustment in interest rates.

Is the stock market regulated by the Federal Reserve?

The Fed, the nation's central bank, is in charge of overseeing monetary policy and administering the financial system. Open market operations, which regulate the purchasing and selling of U.S. Treasury and federal agency securities, are its main monetary policy tool.

Who owns the US Federal Reserve?

Individual stockholders do not exist. Member banks, who are required to subscribe to the stock of the Federal Reserve Bank in their district in an amount equivalent to 6% of the capital and surplus of the member bank, possess all of the stock. Only 3% of this subscription, or half, has actually been paid.