Defining a stop loss order

Stop-loss orders are instructions sent to a broker to either buy or sell a stock at a predetermined price. An investor's loss on a security position can be controlled using a stop-loss. Setting a stop-loss order 10% below the price at which you purchased the stock, for instance, would restrict your loss to 10%. Imagine you have just invested $20,000 in Microsoft (MSFT) at a price of $20 per share. You buy the stock and immediately place a stop-loss order to prevent losing more than $18. Your stock will be sold at the current market price if it drops below $18.

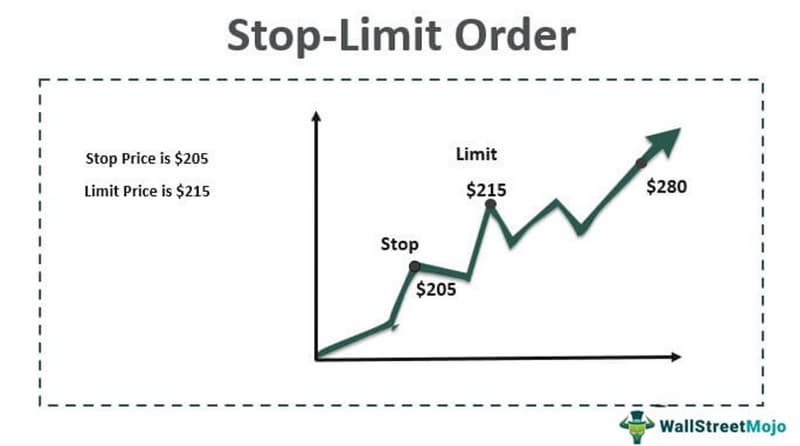

Both stop-loss and stop-limit orders function in a similar fashion. However, as implied by the name, they have a maximum acceptable execution price. The stop price, at which point the order is converted to a sell order, and the limit price are the two prices stated in a stop-limit order. The sell order converts into a limit order that will only be filled at the specified limit price, rather than at the market price (or better).

How do they work?

Stop-loss orders aren't just for protecting against losses; they can also be used to secure a profit target. If a trader purchases a stock for $2 per share and its price subsequently climbs to $5 per share, the trader may set a stop-loss order at $3 per share, securing a $1 per share profit should the stock's price fall back to $3.

If you're familiar with limit orders, you know that they're only fulfilled if the security can be purchased (or sold) at the set price or better. Stop-loss orders automatically convert to market orders to purchase or sell at the current best available price once the price of a security reaches or exceeds the stated stop-loss order price.

A stop-loss order may not be filled at the precise stop price level indicated, especially in a volatile market, but will typically be filled within a small range around that price. Traders should be aware that stop-loss orders may not be able to prevent significant losses in extreme situations.

If a trader buys a stock at $20 per share and sets a stop-loss order at $18, but the price eventually closes at $21 on a given trading day, the trader will incur a loss of $2. Then, after the market closes, terrible information about the company emerges.

If the stock opens the next trading day at $10 per share, for example, and the trader has a stop-loss order set at $18, the order will be immediately triggered because the price has gone below the stop-loss order price; however, the order will not be completed at or around $18 per share. As a result, it will be filled at a price close to the current market price of $10 per share.

Limit orders ensure that your order will be filled at the specified price or better. In the event that a stop-loss order is triggered, the only assurance is that the order will be executed immediately and filled at the current market price.

What is the purpose of stop-loss orders?

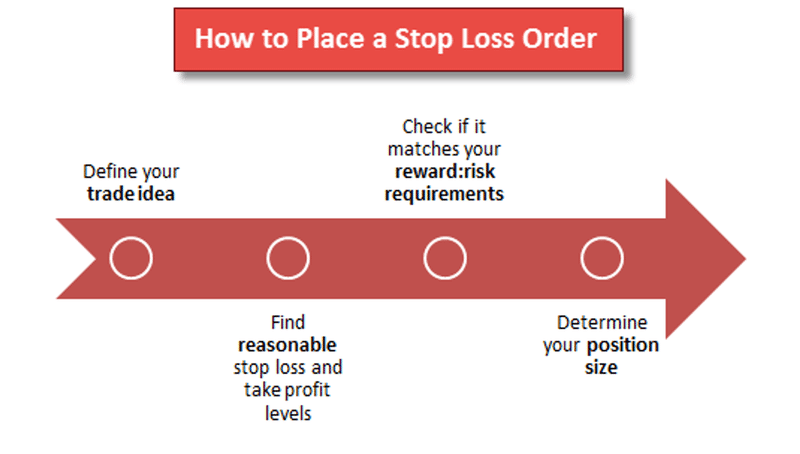

A stop-loss order can help traders minimize their losses and lower their overall risk (by already having an order in place that will automatically be executed if the market trades at a specified price).

Traders should never enter a trade without first placing a stop-loss order to protect themselves from a large loss. Stop-loss orders, in a nutshell, reduce exposure to lose by restricting the proportion of trading capital committed to a single trade.

Benefits of stop-loss orders

The key benefit of a stop-loss order is that it can be implemented at no additional cost. In the event that the stop-loss price is reached and the stock is sold, only then will you be subject to the normal commission. A stop-loss order might be seen as a form of complimentary insurance.

You also don't have to keep a close eye on a stock's performance every day if you use stop-loss orders. This feature comes in very handy when you can't keep an eye on the market for a lengthy period of time, such as while you're on vacation.

As an added bonus, stop-loss orders can help you keep your emotions out of your trading. It's common for investors to develop a romantic attachment to their stock holdings. They may, for instance, mistakenly believe that a stock is about to turn around if only they give it another chance. In reality, the longer we wait, the more damage we might do to our finances.

Whatever your investment style, you should always be able to articulate the rationale for your stock holdings. The standards used by a value investor will vary from those used by a growth investor, who will in turn have different standards than those used by a day trader. It's important to remember that every plan you implement relies on your diligence in seeing it through to completion. As a result, stop-loss orders won't help you much if you're a true buy-and-holder.

Having faith in your plan is essential if you want to make money as an investor. That involves actually doing what you've set out to do. Stop-loss orders have the benefit of keeping you on track and preventing you from letting your emotions cloud your judgment.

To conclude, remember that even with stop-loss orders in place, success in the stock market still requires careful planning and foresight. Don't do it, and you'll end up losing as much money as if you didn't have a stop-loss at all (only at a much slower rate.)

A stop-loss order is a simple and effective tool for limiting financial exposure to potential trading losses.

- Trading with them can help you lock in a profit.

- Any investor can benefit from including them in their portfolio.

- They provide structure for a trader's short-term activities.

- They eliminate the need for human emotion in the trading process.

- You won't have to keep checking in on your investments every day (or even hourly).

Drawbacks of stop-loss orders

One major drawback is that the stop price might be triggered by a temporary change in the stock price. Selecting a stop-loss percentage that permits day-to-day volatility while protecting against losses is crucial. If a stock has a history of moving 10% or more in a week, it may not be wise to set a stop-loss order of 5%. As a result of your stop-loss order being executed, the only thing you'll lose is the commission.

Stop-loss levels are a matter of personal preference and are not dictated by any universal standards. While a level of 5% could suit a day trader, a number of 15% or more might be more appropriate for a long-term investor.

Be aware, too, that once the stop price is reached, the stop order automatically converts to a market order. As a result, the stop price and the selling price may be very different. Stop-loss orders have other limitations, such as the fact that many brokers won't let you use them on OTC Bulletin Board or penny stocks.

Even more, dangers may arise from using stop-limit orders. Although these orders can guarantee a certain price, they may not always be filled. In a rapid market, this can be disastrous for investors if the stop order is triggered but the limit order isn't filled in time to prevent the market price from exploding past the limit price. If a stock's limit price is only $1 or $2 below its stop-loss price and the company experiences unfavorable press, the investor will be forced to sit on their hands for an indefinite period of time before the share price recovers. Day orders and good-until-canceled (GTC) orders can be placed for either order type.

Stop-loss order examples

A trader decides to invest $100 in XYZ Company stock and places a stop-loss order for 90 dollars per share. In the coming weeks, the share price will fall below $90. The stop-loss order is activated, and the trader sells the position at $89.95, incurring a small loss. The market continues to slide.

To hedge against potential losses, a trader purchases $5000 worth of ABC Corporation stock at $100 per share. After the stock market closes, the company announces disappointing profits. ABC's stock price drops immediately upon the opening of trading the next day. In this case, the trader's stop-loss order has been activated. The order is filled at a price of $70.00, resulting in a loss of $20.00. Despite this, the market remains in a downward trend, eventually closing at 49.50. Even if the stop-loss order wasn't able to safeguard the trader in the way it was designed to, it nonetheless significantly mitigated the potential damage.

In conclusion

When implemented correctly, a stop-loss order is a straightforward technique that can yield substantial benefits. Whether you're trying to limit your losses or secure your gains, this tool can help. Consider the stop-loss to be an insurance policy: You certainly hope you'll never need it, but it's comforting to have peace of mind knowing you have it.

FAQ

What is a stop-loss order?

A stop-loss order is placed after a position has been opened in a security (either on the buy or sell side) with instructions to liquidate the position by selling (or buying) the security at the market if the price of the security reaches a certain level.

How do stop-loss orders limit losses?

If the market price of your stock falls below a certain threshold, your stop-loss order will cause your trades to be terminated automatically, protecting you from further losses. Protecting yourself from losses when the value of your position rises is possible with a trailing stop. Therefore, a loss may result in diminished profits rather than a total loss.

Are stop-loss orders essential for long-term investors?

Most likely not. Long-term investors shouldn't be overly concerned with market fluctuations because they're in the market for the long haul and can wait for it to recover from downturns. However, they may and should monitor market fluctuations to decide if corrective measures are necessary when a market falls. For instance, rather than selling off their holdings during a slump, they could instead choose to increase their exposure.

Do stop-loss orders always need to get filled?

Investors have more say in how their order is filled with a stop-limit order, but that doesn't mean they'll always get the price they want. Your stop-limit order will not be filled if there are no bids that meet your specified criteria.

How many days is a stop-loss order valid?

A stop-loss order has a 24-hour time limit on its effectiveness. When the trading day ends and your stop loss order has not been executed, it will expire. A GTT order you make can stay open for up to 365 trading days (one year) or until the trigger condition is met.